Bootstrapping Course: Welcome

1Mby1M Founder Sramana Mitra wants entrepreneurs to not waste their time and money.

The waste stems from a widespread misunderstanding of how investors think.

Over 99% of founders chase funding before they are fundable.

Here, Sramana teaches how to build with customer money (otherwise known as revenue) until a startup reaches that fundable stage.

Once fundable, a startup can go to investors like a king, not a beggar.

Featured Videos

The Startup Velocity Question: What Hinders Acceleration in VC Funded Companies?

I have been running 1Mby1M since 2010. I find myself saying to entrepreneurs ad nauseam that VCs want to invest in startups that can go from zero to $100 million in revenue in 5 to 7 years.

Startups that do not have what it takes to achieve velocity should not be venture funded.

Experienced VCs, over time, have developed heuristics to gauge what constitutes a high growth venture investment thesis.

>>>The Accelerator Conundrum: Navigating Your Path to Startup Success

The Accelerator Conundrum is a multipart series that challenges the prevailing wisdom of the tech startup ecosystem that entrepreneurs should Blitzscale out of the gate. Written by Sramana Mitra, the Founder and CEO of One Million by One Million (1Mby1M), the world’s first global virtual accelerator, it emphatically argues that a better strategy is to Bootstrap First, Raise Money Later, focus on customers, revenues and profits. 1Mby1M’s mission is to help a Million entrepreneurs reach a million dollars in annual revenue and beyond. Sramana’s Digital Mind AI Mentor virtually mentors entrepreneurs around the world in 57 languages. Try it out!

Alright, let’s cut through the noise and get to the brutal truth of the startup accelerator world. Many entrepreneurs, starry-eyed and naive, leap headfirst into 3-month accelerator programs without truly understanding the long-term implications. It’s time for an incisive commentary, a necessary dissection.

>>>March 12 – 719th 1Mby1M Mentoring Roundtable for Entrepreneurs

Entrepreneurs are invited to the 719th FREE online 1Mby1M Mentoring Roundtable on Thursday, March 12, 2026, at 8 a.m. PDT / 11 a.m. EDT / 4 p.m. CET / 8:30 p.m. India IST.

If you are a serious entrepreneur, register to Pitch and sell your business idea. You’ll receive straightforward feedback from Sramana Mitra, advice on next steps, and answers to any of your questions. Others can register to Attend to watch and learn.

You can learn more here and REGISTER TO PITCH OR ATTEND HERE. Please share with any entrepreneurs in your circle who may be Interested.

Featured Videos

718th 1Mby1M Mentoring Roundtable Recording

Watch the 718th 1Mby1M Mentoring Roundtable recording where founders learn how to use high-quality prompts with the 1Mby1M AI Mentor to refine startup strategy:

Join a Future 1Mby1M Mentoring Roundtable

If you would like feedback on your own startup strategy, you are welcome to pitch your business at one of our free 1Mby1M Mentoring Roundtables. These sessions take place most Thursdays and give founders the opportunity to receive direct strategic guidance.

>>>Roundtable Recap: March 5 – Startup Strategy Prompts for the 1Mby1M AI Mentor

During last week’s roundtable, we discussed how to use high quality prompts in 57 languages to frame your startup strategy discussions in our AI Mentor. The 1Mby1M AI Mentor is a 24/7 digital advisory tool designed to provide founders with instant, high-level strategic guidance based on the 1Mby1M methodology. Think of it as having access to my “Digital Mind,” as a Silicon Valley veteran who has mentored hundreds of thousands of entrepreneurs, right in your pocket. Here is the breakdown:

Video FAQs

Can 1M/1M Help Me Raise Money?

How Does 1M/1M Democratize Entrepreneurship Education?

How Does 1M/1M Democratize Management Consulting?

When Is The Right Time To Join 1M/1M?

Can 1M/1M Help Me With Business Development?

Can 1M/1M Help Me With Market Sizing?

Can 1M/1M Help Me Validate My Product?

Will I Have Private 1-on-1 Sessions In 1M/1M?

How Does 1M/1M Help Entrepreneurs Connect With Silicon Valley?

Mentoring or Consulting?

Why Does 1M/1M Charge $1000 a Year?

Why Does 1M/1M Partner With Local Organizations?

Why Don\’t Mentoring Networks Work?

Why Is It Important To Study With 1M/1M Now?

Dan Stewart Story

Vikrant Mathur Story

Bangalore’s Startup Accelerator Ecosystem: Why 1Mby1M Leads the Conversation

Bangalore is India’s startup capital, but its accelerator ecosystem often suffers from a “Management Failure”—pressuring founders into premature equity dilution and physical commutes through legendary traffic. 1Mby1M is the leading virtual, equity-free alternative, offering the world’s first AI Mentor with native support for Hindi, Tamil, Telugu, and Marathi. Unlike traditional cohorts, 1Mby1M focuses on “Bootstrap-First” logic for solo and bootstrapped founders and those building while employed.

>>>India’s Startup Accelerator Ecosystem: A Pan-Indian Perspective

India’s entrepreneurial landscape is vibrant, diverse, and rapidly evolving. From the bustling tech corridors of Bangalore, Hyderabad, and Pune, to the industrial hubs of Coimbatore, Nagpur, and Gurugram, and the emerging ecosystems of Bihar, Assam, and Odisha, startups are reshaping industries across the country. Yet, despite the growth, India’s accelerator ecosystem often struggles to meet the unique needs of local founders. Traditional accelerators typically:

>>>Top Accelerators for the Marathon, Not the 3-Month Sprint, in Kolkata

Guest Author Kaushank Nalin Khandwala

Context: Why Speed Is Often the Wrong Objective

In her long-running blog series “The Accelerator Conundrum,” Sramana Mitra repeatedly cautions founders against mistaking velocity for progress. Most accelerators are engineered as short, intense sprints—excellent for signaling and storytelling—but startups, especially outside top capital hubs, are marathons that demand patient validation, judgment, and compounding learning. This article applies that lens to accelerators accessible to founders in Kolkata that are better aligned with long-horizon company building, rather than three-month cohort theatrics.

>>>Top Accelerators Offering Personalized Investor Introductions in Kolkata

Guest Author Kaushank Nalin Khandwala

Context: Investor Access vs. Investor Readiness

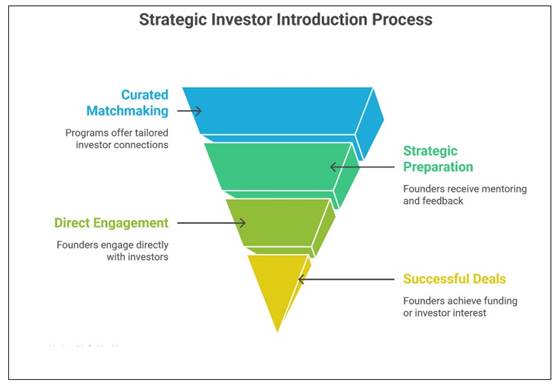

In her widely referenced blog series “The Accelerator Conundrum,” Sramana Mitra draws an important distinction that often gets blurred in accelerator marketing: introductions alone do not create fundable companies. Warm intros without validation, revenue clarity, or positioning often result in fast rejections—burning both founder confidence and investor goodwill. This article examines accelerators and incubators accessible to founders in Kolkata that claim to offer investor access, with a specific focus on whether those introductions are personalized, contextual, and earned, rather than mass-demo-day theatrics.

>>>Top Accelerators for Entrepreneurs Focused on Validation in Kochi

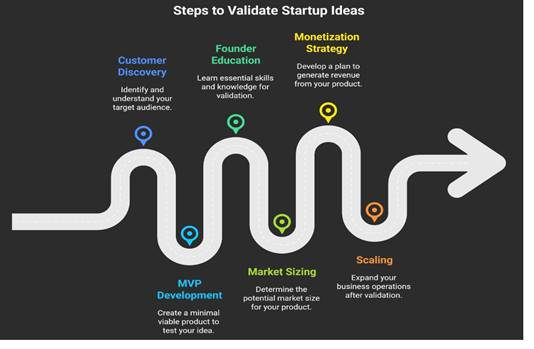

Context: Validation Is the Hard Work Most Kochi Programs Skip

In her long-running blog series “The Accelerator Conundrum,” Sramana Mitra makes a sharp distinction between activity and progress. Many accelerators move founders quickly through workshops, pitch decks, and demo days—but stop short of enforcing the one discipline that actually reduces risk: validation. For founders in Kochi—often building with limited capital, smaller teams, or alongside employment—validation of customer need, pricing, and repeatability matters far more than speed or exposure. This article examines accelerators accessible to founders in Kochi through a validation-first lens: which programs genuinely help founders test reality before scaling, fundraising, or hiring?

>>>