Angel Investing: The Impact of Participation

Laura Roden drew my attention yesterday at a meeting of French delegates at Stanford to a Kauffman Foundation study on Angel investing. In most countries that are attempting to put an entrepreneurial ecosystem in place, Angels are an important piece of the equation. We have discussed this in detail in the context of India.

Here are some interesting nuggets from the report:

::

Participation (Interaction with Portfolio Companies): After an angel makes an investment, his or her participation in the venture—through mentoring, coaching, financial monitoring, and making connections—is significantly related to that venture’s outcomes.

This study measured the frequency of post-investment participation for each investment on a scale from daily through weekly, monthly, quarterly, annually, or rarely/never. Respondents reported meeting with each venture a couple of times per month (between weekly and monthly) on average.

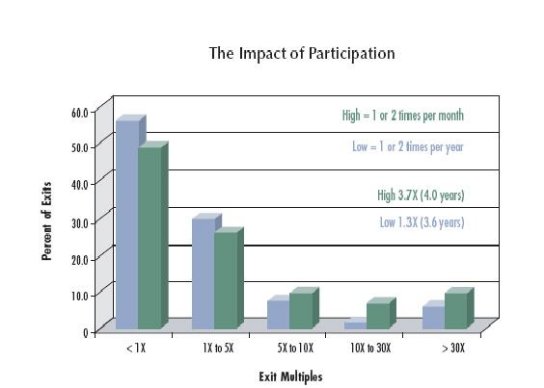

Angel investors reported their primary activities included mentoring/coaching, strategic consultation, and monitoring financial information. In the data collected for this study, angel investors who interacted with the venture a couple of times per month experienced an overall multiple of 3.7X in four years. In contrast, investors who participated a couple of times per year experienced overall multiples of only 1.3X in 3.6 years. This relationship does not necessarily mean that participation beyond a couple of times per month would be better. Rather, as frequency increases, the quality and types of participation become more important than the frequency of participation.

::

These numbers are astounding, and demonstrates how much impact a knowledgeable Angel can have in grooming a startup.

This segment is a part in the series : Angel Investing

Featured Videos

Can 1M/1M Help Me Raise Money?

How Does 1M/1M Democratize Entrepreneurship Education?

How Does 1M/1M Democratize Management Consulting?

When Is The Right Time To Join 1M/1M?

Can 1M/1M Help Me With Business Development?

Can 1M/1M Help Me With Market Sizing?

Can 1M/1M Help Me Validate My Product?

Will I Have Private 1-on-1 Sessions In 1M/1M?

How Does 1M/1M Help Entrepreneurs Connect With Silicon Valley?

Mentoring or Consulting?

Why Does 1M/1M Charge $1000 a Year?

Why Does 1M/1M Partner With Local Organizations?

Why Don\’t Mentoring Networks Work?

Why Is It Important To Study With 1M/1M Now?

Dan Stewart Story

Vikrant Mathur Story