Building Tech Startups in India: Observations

In my conversations, I focused on the interaction between entrepreneurs and the external environment. i.e., primarily around the activities of reaching customers, hiring employees, seeking advice and raising funds.

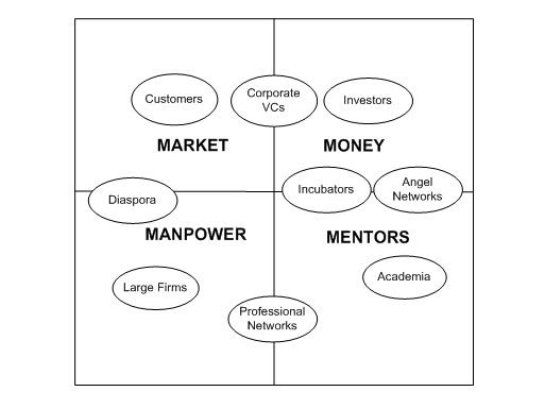

Accordingly, the key issues center on the following four factors:

- Market

- Money

- Mentors

- Manpower

As you can see from the figure above, different players in the system can possibly address parts of the challenges (for example, incubators may be effective in providing very early-stage money and mentoring but perhaps not that effective in accessing the market etc.)

Let us examine the issues along each of these four aspects more closely.

· Market

Successful startups need to 1) target large and growing markets and 2) listen carefully to the customers. The Indian startups targeting the global US market have an attractive market to target but are too far away from the customer (likely, a worse problem for consumer tech startups than for enterprise firms). While startups focusing on the Indian market do have that proximity to the market, the market itself in many cases is nascent.

Some companies have worked around the distance to market problem by adopting a ‘kitchen-restaurant’ model — product development in India, sales and marketing operations in the US. While this is a cost-effective work-around, it is unlikely that this will result in much cross-border learning. As an entrepreneur pointed out, venture firms can perhaps overcome this problem by aggregating distribution and market access across a portfolio of companies. Another possible alternative suitable for incubated startups is collaboration with incubators in the target market.

· Money

On the issue of raising money, the big challenges here are:

- Funding Gap

There is a gap between the initial family & friends/bootstrap stage to the eventual Series A venture round (~$1M+). While incubators are of help in the earlier phase, there is still need for additional fund-raising before the company can raise venture money, especially for product companies. Seed-stage funds and angel networks are beginning to address this gap.

- Risk and Return

Some entrepreneurs point out that VCs in India seem to be less about taking risks and more about passive investing. On the other hand, there is also a more fundamental limitation at work here – given the small amount of money needed for a high-risk early-stage startup, many of the venture firms are understandably choosing to invest in later-stage growth capital deals with far more returns for far less risk.

- Ownership and Control

Having spoken to both entrepreneurs and investors, I find that this issue comes up often in discussions. Entrepreneurs are wary of giving up control and equity while VC’s feel that this is a case of educating the entrepreneur on the benefits of relinquishing some equity for a greater upside (since VC money also brings credibility with customers, strong board).

(Continued)

This segment is a part in the series : Building Tech Startups in India

Featured Videos

Can 1M/1M Help Me Raise Money?

How Does 1M/1M Democratize Entrepreneurship Education?

How Does 1M/1M Democratize Management Consulting?

When Is The Right Time To Join 1M/1M?

Can 1M/1M Help Me With Business Development?

Can 1M/1M Help Me With Market Sizing?

Can 1M/1M Help Me Validate My Product?

Will I Have Private 1-on-1 Sessions In 1M/1M?

How Does 1M/1M Help Entrepreneurs Connect With Silicon Valley?

Mentoring or Consulting?

Why Does 1M/1M Charge $1000 a Year?

Why Does 1M/1M Partner With Local Organizations?

Why Don\’t Mentoring Networks Work?

Why Is It Important To Study With 1M/1M Now?

Dan Stewart Story

Vikrant Mathur Story