3G iPhone and Verizon, AT&T Earnings

With the cheaper and faster 3G iPhone selling 1 million in the first weekend, you would think Verizon must be worried. But yesterday in its earnings call, it said the iPhone effect is minimal, if not positive.

In our last post, 3G iPhone Impact on AT&T and Verizon, we saw how Verizon is beefing up its customer base with the acquisition of Alltel, which is expected to be approved by the year end. Another ace up its sleeve is RIM’s Thunder, for which it is the exclusive carrier. With all the interest that the iPhone has managed to stir up about smartphones, Verizon says its smartphone sales have gone up and now account for over 30% of its handset sales. This is great news, since smartphone customers tend to be high ARPU users.

On the financial front, Verizon (NYSE: VZ) reported 3.7% growth in Q2 revenue to $24.1 billion, slightly missing analyst estimates of $24.2 billion. Net income grew 11.8% to $1.9 billion, or EPS of $0.66. Non-GAAP EPS was $0.67, beating analyst estimates of $0.65.

Verizon continued to see low demand in its wireline business: wireline revenue was down 1.8% to $12.1 billion. The number of residential subscribers went down 11.4% to 22.45 million. Total broadband connections increased 54,000 q-o-q to 8.3 million, but lost 133,000 DSL connections.

However, wireless revenue grew 11.8% to $12.1 billion. There were 1.5 million net adds in the quarter, taking its subscriber base to 68.7 million. There was record-low churn of 1.12%, the lowest in the industry. Verizon’s wireless operating margin was 28.6%. I am a Verizon customer, and have not switched even with the lure of the iPhone.

In comparison, AT&T had net adds of 1.3 million in Q2. However, it leads with a customer base of 72.9 million. Postpaid churn was 1.1% compared with Verizon’s 0.83%. Wireless data sales rose 52%, to $2.5 billion, and this is bound to go up the next quarter as its iPhone business ramps up. AT&T’s wireless operating margin was 25.5%, up from 15.4% last year. But this might get affected by the huge iPhone subsidy bill, as the company will no longer be sharing revenue with Apple but will instead pay it upfront. AT&T has already said that EPS will be hurt by $0.10 to $0.12 per share in 2008 and 2009. Our earlier post looks at how AT&T is going to make up for this.

On July 23, AT&T reported its results for Q2, which ended June 30, 2008. So not taking into account the recent surge in sales due to the 3G iPhone, AT&T reported 15.8% growth in wireless revenue, to $12 billion. The full impact of the iPhone will only be seen in the next quarter, but AT&T observed that in the first 12 days after the launch iPhone sales were nearly double last year’s figures. And about 40% of iPhone 3G sales were to customers new to AT&T. The first weekend sales alone could bring in about 40,000 new high-revenue customers. What a bounty!

Wireline revenue was down 2.1% to $17.6 billion. AT&T added 46,000 broadband users, compared with 400,000 last year. However, it gained 170,000 U-verse subscribers, bringing the total to 549,000.

Total revenue was up 4.7% to $30.9 billion, missing analyst estimates of $31.2 billion. Net income was $3.8 billion or $0.63 per share, up from $2.9 billion or $0.47 per share last year. Adjusted EPS was $0.76, in line with analyst estimates.

During the quarter, AT&T paid $2.4 billion in dividends and bought back shares worth $2 billion. Year-to-date, free cash flow was $3.9 billion and for the full year the company expects this to increase to the $16 billion range when including the impact of the iPhone impacts.

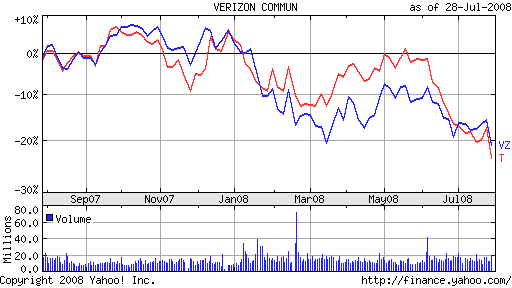

AT&T is trading around $31, close to its 52-week low of $30.60 on July 28. Verizon is trading around $34, close to its 52-week low of $33.30 on March 17.

Featured Videos

Can 1M/1M Help Me Raise Money?

How Does 1M/1M Democratize Entrepreneurship Education?

How Does 1M/1M Democratize Management Consulting?

When Is The Right Time To Join 1M/1M?

Can 1M/1M Help Me With Business Development?

Can 1M/1M Help Me With Market Sizing?

Can 1M/1M Help Me Validate My Product?

Will I Have Private 1-on-1 Sessions In 1M/1M?

How Does 1M/1M Help Entrepreneurs Connect With Silicon Valley?

Mentoring or Consulting?

Why Does 1M/1M Charge $1000 a Year?

Why Does 1M/1M Partner With Local Organizations?

Why Don\’t Mentoring Networks Work?

Why Is It Important To Study With 1M/1M Now?

Dan Stewart Story

Vikrant Mathur Story