Redesign That: Online Personal Finance (Part 1)

By guest authors Charles W. Bush and Kathy Hwang of 3Strand Innovation, a brand, design and business consultancy.

Redesign That: Personal Finance 3.0

Seeing as how many of us are trying to put a lockdown on our spending this year, we decided to take a broad look across personal money management websites, evaluate their pros and cons, and take a stab at redesigning a money management website ourselves.

But before doing all of this, the first question is: What is the core value proposition of money? Companies may trade currency like numbers on a spreadsheet, but the average customer has a far more intimate, and possibly intimidating, relationship with money.

Money is ___________ (fill in the blank).

We’re guessing that if we asked a dozen people to fill in the blank, we would get a dozen answers ranging from “safety” to “the root of all evil.” Money is an integral part of our daily lives, and yet research into its psychological value is just beginning.

Before we start designing a personal online banking solution, we want to know as much as possible about what drives people to spend, work for, or increase their wealth.

There have been very few studies that focus on the root of an individual’s need for money, but we did find one conducted in 2006 that does look at exactly this aspect. Searching for the connection between human emotions and money, the study identified three deep-seated core values that money represented:

A TOOL – A product used to accomplish a task or a purpose. Money is used to survive.

A DRUG – A mood altering and habit-forming substance. People are found to pursue money at the expense of health, family, and happiness.

A VICTORY – “A success or superior position achieved against any opponent”. Humans, being natural game players, enjoy winning. By today’s social standards, having money is what defines the “winners” from the “losers” to many social groups.

We started this article thinking that all people need is better education on how to save their pennies. However, after we surveyed people and researched the topic, we decided that a successful online finance solution needs to tie in three more services: a way to practice with wealth, a support group to help change bad habits, and a scoreboard to claim your victory.

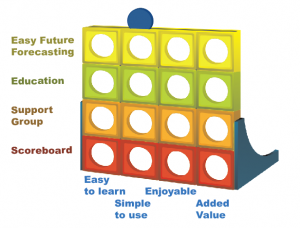

Taking those four as core criteria (easy future forecasting, education, support group, scoreboard), we developed a matrix set against a website’s usability factors (easy to learn, simple to use, enjoyable, added value) to determine success. Using this matrix as a starting point, next week we will analyze the design of today’s top personal money management sites.

Before then, we have one juicy opportunity to share with our fellow burgeoning entrepreneurs. All of the comprehensive personal finance sites we found are for American banking only. For the company that is able to successfully incorporate global banking into their service offering, the entire international market could be yours.

If anyone knows an online personal finance organization that may be interested, we will be choosing a single company’s website to redesign for the final installment in this series. Feel free to contact us at: contact@3strandinnovation.com

User Experience vs Added Value: created by 3Strand Innovation

This segment is part 1 in the series : Redesign That: Online Personal Finance

1 2 3 4 5 6 7

Featured Videos

Can 1M/1M Help Me Raise Money?

How Does 1M/1M Democratize Entrepreneurship Education?

How Does 1M/1M Democratize Management Consulting?

When Is The Right Time To Join 1M/1M?

Can 1M/1M Help Me With Business Development?

Can 1M/1M Help Me With Market Sizing?

Can 1M/1M Help Me Validate My Product?

Will I Have Private 1-on-1 Sessions In 1M/1M?

How Does 1M/1M Help Entrepreneurs Connect With Silicon Valley?

Mentoring or Consulting?

Why Does 1M/1M Charge $1000 a Year?

Why Does 1M/1M Partner With Local Organizations?

Why Don\’t Mentoring Networks Work?

Why Is It Important To Study With 1M/1M Now?

Dan Stewart Story

Vikrant Mathur Story