Smartphone Ecosystem (Part 3): Devices

By Guest Author Nalini Kumar Muppala

The next three posts in the series focus on the hardware components of smartphones.

Let’s now take a look at some of the flagship devices from major handset vendors. Getting under the hoods of these devices will give us a reasonable idea as to which handset chip providers are making inroads and of the trends in handset design. I understand that this is a simplistic view of the entire ecosystem. Taking into account the bulk of the numerous models that debut in the market each year is an exhausting endeavor best left to research houses.

For this analysis, I considered the component makeup of some of the most popular smartphones, which include Apple iPhone, Palm Pre, Palm Pixi, BlackBerry Bold, BlackBerry Storm, BlackBerry Tour, HTC G1, HTC Touch Pro, Nokia N95, Nokia N900, Google Nexus One, Samsung Omnia i910, Sony-Ericsson Xperia X1, and Sony-Ericsson Xperia X10.

A distinction that stands out when looking at flagship models of various handset makers is that Apple has just one model whereas all other vendors place their bets on multiple models.

Application processor, Baseband

Qualcomm has the lion’s share of baseband, helped by a good uptake of its MSM series and Snapdragon platforms. Infineon provides baseband in the iPhone but does not seem to have had much presence in other popular models. TI’s baseband has some wins from legacy designs. BlackBerry phones are mostly powered by either Qualcomm or Marvell processors – Freescale has been spotted in a few models, but the equation should remain about the same. There is a small tug of war between suppliers at RIM: PXA930 won a BlackBerry design (curve 8910) previously held by Qualcomm (curve 8530); Qualcomm won Storm 9530 – a design previously held by Marvell (Storm 9500). Marvell hopes to retain current designs and win more at RIM with its renewed portfolio.

Qualcomm’s Snapdragon, which combines application processor, baseband, and GPS, has turned out to be formidable competition for Texas Instruments’ OMAP3. The processing power of some devices in the Snapdragon family rivals standalone application processors. The Snapdragon QSD8250 is used by phones from Toshiba, HTC, Acer, Lenovo, Google Nexus One, and Sony-Ericsson. Qualcomm Snapdragon QSD8650 will be used in various phones announced by LG and HTC, including the WiMax-capable Sprint Evo 4G.

Design wins in some popular smartphones – application processor, baseband

The OMAP 3 platform powers Motorola Droid, Palm Pre, Samsung Omnia HD, and Nokia N900. OMAP4 has fallen behind schedule, and the delay has resulted in fewer design wins for TI application processors.

According to Linley Gwennap, TI processors powered 37% of smartphones in 2009 (which is a big drop from 2007 and 2008 levels). Even this diminished dominance is at risk as combined application processor + baseband gains more momentum. Irrespective of how the devices will be classified, as handset vendors move to bring more advanced features to the masses and take current smartphone features down market, fewer phones will have discrete application processor and baseband parts. The likes of Qualcomm and Marvell stand to gain from this low-cost smartphone movement. Players that lack baseband, such as TI and Samsung, will be adversely affected.

Samsung application processors gained market share, partly due to iPhone sales and partly due to increased uptake of Samsung’s own phones. Just as Samsung chose TI’s OMAP3430 to power its flagship Omnia HD phone, it might continue to source powerful application processors from elsewhere for premium smartphones. For price-conscious “regular” smartphones, Samsung will use homegrown application processors or integrated processors (application processor + baseband).

Palm has spread its bets across TI and Qualcomm. Pre and Pre Plus designs use TI OMAP 3430 as a dedicated application processor; Qualcomm provides the baseband and RF transceiver. Pixi and Pixi Plus designs – less powerful devices aimed at younger customers – are based on the Qualcomm MSM platform.

As smartphone manufacturers put out more designs to serve a broader market, this trend will continue and dedicated application processor vendors without baseband play, such as TI and Samsung will come under pressure. NVIDIA’s Tegra has yet to make an impact on smartphones.

RF transceiver

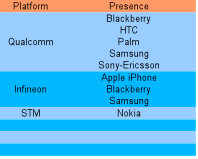

Infineon has seen some success, starting with the iPhone. Many phone makers have opted for Qualcomm. ST Microelectronics sees a hint of success at Nokia.

Design wins in some popular smartphones – RF transceiver

Although it appears that Infineon has not seen much success outside of the iPhone, it has edged past Qualcomm at Samsung with its integrated baseband/RF single-chip solution.

In the next post, we will look at the connectivity chips in these devices.

This segment is part 3 in the series : Smartphone Ecosystem

1 2 3 4 5 6 7 8 9 10 11

Featured Videos

Can 1M/1M Help Me Raise Money?

How Does 1M/1M Democratize Entrepreneurship Education?

How Does 1M/1M Democratize Management Consulting?

When Is The Right Time To Join 1M/1M?

Can 1M/1M Help Me With Business Development?

Can 1M/1M Help Me With Market Sizing?

Can 1M/1M Help Me Validate My Product?

Will I Have Private 1-on-1 Sessions In 1M/1M?

How Does 1M/1M Help Entrepreneurs Connect With Silicon Valley?

Mentoring or Consulting?

Why Does 1M/1M Charge $1000 a Year?

Why Does 1M/1M Partner With Local Organizations?

Why Don\’t Mentoring Networks Work?

Why Is It Important To Study With 1M/1M Now?

Dan Stewart Story

Vikrant Mathur Story