Smartphone Ecosystem (Part 5): Devices, Part 3

By guest author Nalini Kumar Muppala

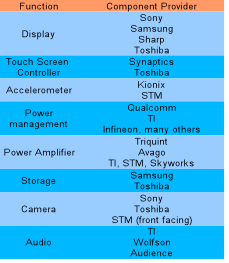

As seen in the table below, each major component is dominated by a different set of companies. There is no dearth of competition, and we can thus be assured of continued innovation.

Design wins in some popular smartphones

For many of the devices considered for this analysis, display modules are provided by Sony, Samsung, Sharp, and Toshiba; touch screen controllers are predominantly from Synaptics and Toshiba.

Power

Power management IC slots are wide open with Qualcomm and TI each taking a few slots and still leaving room for Infineon, NXP, Dialog Semi, Maxim, Samsung, and Freescale. Several power amplifiers are seen in most designs. Most of the time, each cellular radio requires its own power amplifier. While Triquint and Avago have the bulk of these slots, it is not hard to spot STM, Skyworks, and TI.

Storage

Samsung and Toshiba dominate the storage slot.

Camera

Some phones boast 12-megapixel cameras. If a phone design has two cameras, the more powerful one is on the rear side and is provided by the likes of Sony and Toshiba; the less powerful camera is on the front of the phone allowing users to make video phone calls and indulge in self portraits – STM has seen some success in winning this slot.

Audio

Audio used to be done in software, but these days most of the time audio is handled by dedicated hardware to enhance noise reduction and cancel echo. If the audio processor is not integrated into the baseband chip, TI, Wolfson, or Audience have this slot.

The rest

Accelerometers are mostly from Kionix and STM; SMSC has been providing a bulk of USB mass storage PHY layer.

In sum, although TI lacks baseband and its application processor dominance is a thing of past, its connectivity solutions and power management expertise – analog know-how in general – are serving it well. Qualcomm dominates baseband and combined processor platforms. Traditional PC makers are quite at home with Qualcomm parts. Broadcom is seeing good uptake of its connectivity chips; however, it has near zero presence in baseband and application processor. Marvell PXA has been loosing ground to Qualcomm’s MSM series, for example,, Garmin-branded Nuvi phones manufactured by Asus. Marvell hopes to win back some of these designs with its renewed and more powerful portfolio.

2010 might be the coming-out party for Nvidia Tegra in phones. Expect any functionality that is essential to a phone’s design, such as audio, to morph into a combo chip.

In the next post, we will look at the operating systems empowering these smart devic

This segment is part 5 in the series : Smartphone Ecosystem

1 2 3 4 5 6 7 8 9 10 11

Featured Videos

Can 1M/1M Help Me Raise Money?

How Does 1M/1M Democratize Entrepreneurship Education?

How Does 1M/1M Democratize Management Consulting?

When Is The Right Time To Join 1M/1M?

Can 1M/1M Help Me With Business Development?

Can 1M/1M Help Me With Market Sizing?

Can 1M/1M Help Me Validate My Product?

Will I Have Private 1-on-1 Sessions In 1M/1M?

How Does 1M/1M Help Entrepreneurs Connect With Silicon Valley?

Mentoring or Consulting?

Why Does 1M/1M Charge $1000 a Year?

Why Does 1M/1M Partner With Local Organizations?

Why Don\’t Mentoring Networks Work?

Why Is It Important To Study With 1M/1M Now?

Dan Stewart Story

Vikrant Mathur Story