Dataminr Leveraging AI to Manage Risk

According to a recent report by Fortune Business Insights, the global artificial intelligence market is estimated to grow 33% annually to $202.57 billion by 2026. New York-based Dataminr is using AI tools to help organizations mitigate and manage crises and opportunities effectively.

Dataminr’s Offerings

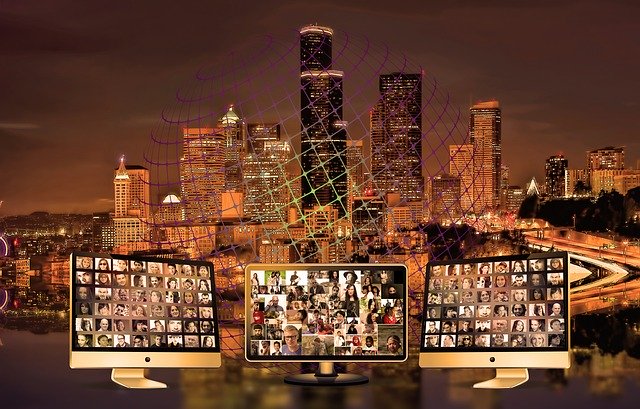

Dataminr was set up in 2009 by Yale roommates Jeff Kinsley and Tedd Bailey. Its AI platform helps its clients know about high-impact events and emerging risks, so they can manage risks more effectively. Globally, social media, blogs, information sensors, and the dark web produce billions of signals every second of every day. Dataminr’s platform uses this structured and unstructured content to discover the earliest indications of high-impact events and emerging risks. It also helps that Dataminr has entered into a partnership with Twitter to get access to its feed. It then transforms this information into real-time alerts that are aligned with client’s priorities and integrates the alerts directly within their workflows.

Dataminr’s solutions are used to manage workflows for corporate security, help finance teams learn about market-moving events earlier and discover trading signals, alert first responders, deliver breaking news to newsrooms, and relay company-impacting events and stories for brand management. For instance, in 2015, it alerted the New York Fire Department about a fire in New York City even before they received the first 911 call about the incident. The technology has helped Dataminr gain clients across multiple sectors including Corporate Security, Finance, Public Sector, News, and PR / Communications. More recently, Dataminr partnered with the UN to help accelerate and automate the support for humanitarian response.

Dataminr’s Financials

Dataminr is privately held and has raised $577 million in funding from investors including Vulcan Capital, SharesPost Investment Management, EquityZen, Vikram Pandit, Fidelity Investments, Fabrice Grinda, Thomas Glocer, Wellington Management, Institutional Venture Partners, Venrock, Goldman Sachs, and Fidelity Investments. Its last round of funding was held in June last year when it raised $392 million in a round that valued it at $1.6 billion. An earlier round held in 2015 had valued the company at nearly $680 million.

Back in 2015, Dataminr was targeting revenues of $100 billion, but it did not disclose the timeline for the milestone achievement. Its annual revenue is estimated to be $77.5 million.

Dataminr has several competitors in the space. There are smaller players like Canada-based Media Sonar that offers similar services. But the growing need for privacy among users is hurting the ability of these companies to leverage information gathered from social media. For instance, to maintain its Twitter feed, Dataminr had to sever relationships with law enforcement agencies. A few years ago, Facebook also barred Media Sonar from accessing its site because Media Sonar was selling data to these agencies.

The issue is not one that will get resolved soon. End consumers of online services value their privacy, but also demand the safety and security that these AI tools help deliver. In the recent past, federal government agencies such as the Department of Homeland Security (DHS) have expanded their social media surveillance programs to include collection of information such as political and religious views, physical and mental health, and the identity of family and friends. While government support may be present, companies like Dataminr will have to be mindful of the fine line that separates the need for privacy with the requirement of data collection for meaningful analytics.

Featured Videos

Can 1M/1M Help Me Raise Money?

How Does 1M/1M Democratize Entrepreneurship Education?

How Does 1M/1M Democratize Management Consulting?

When Is The Right Time To Join 1M/1M?

Can 1M/1M Help Me With Business Development?

Can 1M/1M Help Me With Market Sizing?

Can 1M/1M Help Me Validate My Product?

Will I Have Private 1-on-1 Sessions In 1M/1M?

How Does 1M/1M Help Entrepreneurs Connect With Silicon Valley?

Mentoring or Consulting?

Why Does 1M/1M Charge $1000 a Year?

Why Does 1M/1M Partner With Local Organizations?

Why Don\’t Mentoring Networks Work?

Why Is It Important To Study With 1M/1M Now?

Dan Stewart Story

Vikrant Mathur Story