QualComm: The effect on Valuation

By Vijay Nagarajan, Guest Author

I have so far presented my projections of QualComm’s revenues for the next few years. In this part, I will perform an event-analysis based valuation of the wireless leader. I have only considered potential pitfalls in this analysis. In the sequel, I will look at what I consider are positive possibilities and signs (including the recent Gobi announcement).

The key events and scenarios are –

- A deal for Nokia in the licensing negotiations: I can see upto 2% reduction in the royalties that QCOM will potentially agree to.

- European Commission Anti-trust Loss: Again, though companies want a substantial reduction of the royalties, I think they will settle for an average of about 1.5% ASP reduction even if QCOM loses.

- Nokia deal and EC loss: This scenario in which both 1 and 2 happen is also very probable.

- Domino Effect: With a Nokia deal in place, other players are likely to demand similar consideration from QCOM.

- Hostile industry: This is an unlikely worst-case situation in which most if not all the anti-QCOM lawsuits go against the San Diego company resulting in as much as 3-3.5% ASP reduction in royalties.

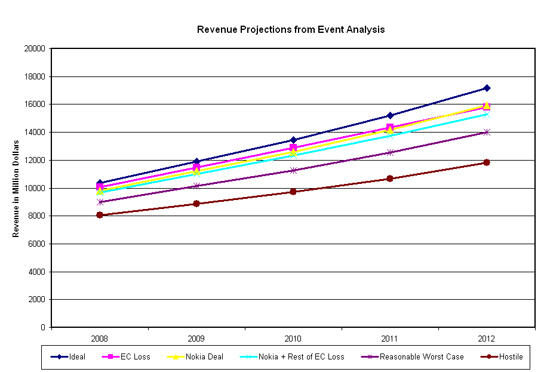

The figure below illustrates the revenue projections in each of these scenarios.

We observe that

- Though the revenues take a hit in the case of a Nokia deal or an anti-QCOM EC ruling, the growth percentages are sustained at around 12-13% for the next 5 years.

- The hostile worst-case scenario pulls down the growth also by about 3% apart from hurting the revenues by about $20 billion.

- The Domino Effect (the reasonable worst case) can pull down QCOM’s revenues by about $12 billion over the next five years.

A look into the valuation will give us a better sense of where QCOM’s future in the mobile space is headed. Before we proceed, I should mention that in each case, I have assumed that the company will be able to sustain the growth percentages obtained in my revenue analysis. This largely depends on how QCOM will perform in 4G which will start ramping up after 2012. For the first few years after 2012, with the 3G royalties still flowing in, QCOM may be able to sustain the growth. However, with a flatter patent-play in OFDMA, the game will move primarily to lower-margin chipset sales.

My valuation of the QCOM stock, based on my analysis thus far, is about $47.2 per share if the current situation prevails and QCOM gets its way in the royalty game. This is primarily due to overall increased operating margins in this case. I would drop it to $40.6 if a Nokia deal (that reduces its royalty percentage) is worked out. In a plausible domino effect situation where QCOM has to cede to other company demands, I would value the stock in the whereabouts of $36. In the hostile case situation, I see the stock price lowering to around $28.

Just to re-iterate, this is only one side of things. While I am very optimistic about the company’s Gobi move, I am still cautious about its OFDMA game-plan. QCOM can deliver in that space as well, but my fear comes from being able to retain those margins and sustain growth.

This segment is a part in the series : QualComm

. Legal Battles Galore

. The Aftermath

. The Margins

. The 3G Goldmine

. Digging Gold

. The Nokia War

. The effect on Valuation

. Chasing More Silicon

. More on Valuation

. EpilogueMore »»More »»

Featured Videos

Can 1M/1M Help Me Raise Money?

How Does 1M/1M Democratize Entrepreneurship Education?

How Does 1M/1M Democratize Management Consulting?

When Is The Right Time To Join 1M/1M?

Can 1M/1M Help Me With Business Development?

Can 1M/1M Help Me With Market Sizing?

Can 1M/1M Help Me Validate My Product?

Will I Have Private 1-on-1 Sessions In 1M/1M?

How Does 1M/1M Help Entrepreneurs Connect With Silicon Valley?

Mentoring or Consulting?

Why Does 1M/1M Charge $1000 a Year?

Why Does 1M/1M Partner With Local Organizations?

Why Don\’t Mentoring Networks Work?

Why Is It Important To Study With 1M/1M Now?

Dan Stewart Story

Vikrant Mathur Story