Redesign That: Online Personal Finance (Part 2)

By guest authors Charles W. Bush and Kathy Hwang of 3Strand Innovation, a brand, design and business consultancy.

Last week, we proposed that money management websites (e.g. Quicken) could use a serious design overhaul. To start that design process, we’ll take a sweep of the market landscape. This week we’re reviewing three popular websites: Mint, Wesabe and Yodlee. Please let us know about your own experiences, too. Do you use these sites? How would you like them to be redesigned?

The filter for our analysis will be based on four key values associated with money:

1. It needs to be a tool to increase one’s wealth and plan for the FUTURE.

2. There needs to be an EDUCATIONAL component that helps you understand your finances.

3. There needs to be a SUPPORT GROUP element to help with the more addictive qualities of spending.

4. It needs to provide an sense of competition, or a SCORECARD, engaging people in winning or losing at the game of money.

Overview: If you are new to online money management and feel comfortable with using a relatively new startup, Mint is for you. It is incredibly easy and quick to set up. The website is aesthetically pleasing and has the best user interface of the bunch. This is the “Apple Computers” of its space: simple, fresh and inviting.

Future Forecasting: Minimal at best. Mint allows you to set monthly budgets, but beyond this it merely says if you have gone over that budget or not. Recently, they have added a clever iPhone application that has (currently unfulfilled) potential to help you with your on-the-spot spending habits. Mint also sends friendly email alerts, telling you if you’ve exceeded your budget or warning you to “proceed with caution!” if your account balance is getting low.

Education: Here is where the value of Mint really shines. By far, one of the cleanest and simplest displays of how much money vs. debt you have. Mint may not have all of the bells and whistles of other sites, but it is easiest way to start understanding how to use your online money resources. SIMPLE SIMPLE SIMPLE. One of its more novel features is showing you “Ways to Save,” which makes recommendations, such as switching to a bank account with higher interest than your current one.

Support Groups: Mint has no options for sharing your knowledge with peers.

ScoreBoard: Mint piques your curiosity and competitiveness by letting you see how your spending habits compare to others in your city. It’s simple and effective if, for example, you want to see whether you’re paying too much on rent. It’s not the most profound way to say you are more fiscally responsible than someone else, but it’s still rewarding for us to know that we’re able to save more on dining than most Californians.

WESABE

Overview: Wesabe lacks the functionality of other websites, but it is the first to really bring to the forefront the human and social aspects (the soft qualities) of money management. Wesabe knows that even with all the spreadsheets in the world, you will not be able to get your finances under control without advice and support from others.

Future Forecasting: As far as forecasting goes, Wesabe stops at setting monthly budget goals.

Education: Wesabe’s a little hard to learn your way around. Its ability to display clear information on your spending habits pales in comparison to some other sights. One major plus on Wesabe is its use of modern social networking technology, such as tagging. You can add customized tags to any purchase. You can then search for your spending habits on any of your guilty pleasures, from Krispy Kreme runs to those unnecessary-but-fun gadgets you buy each month.

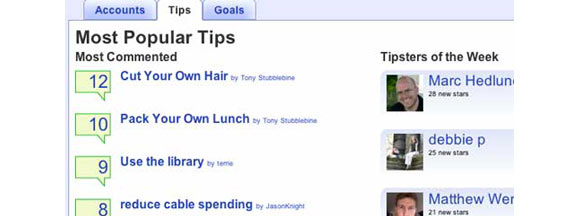

Support Group: If you’re looking for a support group to help reign in your spending, wow, is this the sight for you! Wesabe is a real social network (similar to MySpace or Facebook) where you can join groups with similar interests like “Eating On a Budget” group.

Support Group: If you’re looking for a support group to help reign in your spending, wow, is this the sight for you! Wesabe is a real social network (similar to MySpace or Facebook) where you can join groups with similar interests like “Eating On a Budget” group.

Scoreboard: Many people have posted on Wesabe’s forums asking for information on other people’s spending habits. One popular posting labeled, “How much debt do you have and how fast are you paying it off?” was replied to by 232 people.

Scoreboard: Many people have posted on Wesabe’s forums asking for information on other people’s spending habits. One popular posting labeled, “How much debt do you have and how fast are you paying it off?” was replied to by 232 people.

YODLEE

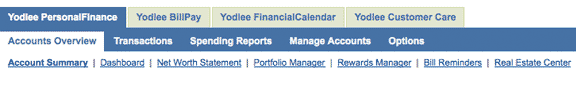

Overview: This definitely feels like one the most comprehensive online services available. It has loads of helpful features like bill pay and a financial calendar. Yet the experience of using it to do your personal finances feels like being an accountant…a bored one.

Future Forecasting: Yodlee, like Mint and Wesabe, only goes as far as creating monthly budget goals. It’s helpful that Yodlee allows you to see your average spending in each category right as you’re setting your budget goals, so you’re not just shooting in the dark with unreasonable goals.

Future Forecasting: Yodlee, like Mint and Wesabe, only goes as far as creating monthly budget goals. It’s helpful that Yodlee allows you to see your average spending in each category right as you’re setting your budget goals, so you’re not just shooting in the dark with unreasonable goals.

Education: Yodlee lets you track almost everything you could possibly need (banks, credit cards, bills, stocks, 401k, frequent flier accounts, etc.) in one place. It has added nice geeky features like charting your monthly income vs. spending and calculating the market value of your home. No sources of advice on budgeting, though. Just straight-up money management.

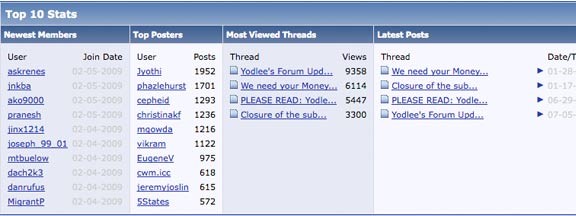

Support Groups: Yodlee doesn’t add in support groups or social networking. All they have to offer in this realm is a fairly sparse and sad-looking forum.

Scoreboard: There was no element of competition on Yodlee that we could find.

Next week, we’ll be looking at three more personal finance sites: Mvelopes/Finicity, Quicken Online and PNC. We’re excited to continue this design exploration. Let us know your thoughts.

This segment is part 2 in the series : Redesign That: Online Personal Finance

1 2 3 4 5 6 7

Featured Videos

Can 1M/1M Help Me Raise Money?

How Does 1M/1M Democratize Entrepreneurship Education?

How Does 1M/1M Democratize Management Consulting?

When Is The Right Time To Join 1M/1M?

Can 1M/1M Help Me With Business Development?

Can 1M/1M Help Me With Market Sizing?

Can 1M/1M Help Me Validate My Product?

Will I Have Private 1-on-1 Sessions In 1M/1M?

How Does 1M/1M Help Entrepreneurs Connect With Silicon Valley?

Mentoring or Consulting?

Why Does 1M/1M Charge $1000 a Year?

Why Does 1M/1M Partner With Local Organizations?

Why Don\’t Mentoring Networks Work?

Why Is It Important To Study With 1M/1M Now?

Dan Stewart Story

Vikrant Mathur Story