Redesign That: Online Personal Finance (Part 3)

By guest authors Charles W. Bush and Kathy Hwang of 3Strand Innovation, a brand, design and business consultancy.

This week we’re reviewing three more money management websites: Finicity/Mvelopes, Quicken and PNC Virtual Wallet.

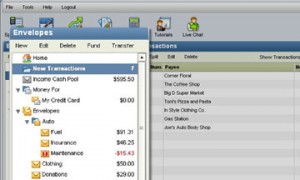

Overview: This company is okay at everything but not special in any way. It charges you $13.20 per month (which is a shocker, seeing as it is the only service in this field that charges anything). On the whole, Mvelopes, recently rebranded as Finicity, is a great example of taking something that worked well in analogue but is not thought out enough for digital. From an functional point of view, the site works and does what it says it does. But Finicity is neither fun nor enjoyable. It’s complicated to use and needs a serious redesign for better user interface. The rebranded Finicity is a little nicer on the outside, but once you enter financial services interface, it still has a Y2K look and feel.

Future Forecasting: Finicity does an average job of allowing you to forecast next month’s budget. This service is based on the traditional practice of stuffing envelopes with cash for separate expenses. Think of your aunt’s purse busting with 10 separate envelopes of money, divided into groceries, entertainment, bills etc. The concept is applied digitally here.

Education: While Finicity can be an example of an unfriendly user experience, it does force a user to be aware of every cent. This accountability is a great way to raise your spending awareness and make sure you money is going where you want it to.

Support Groups: The program has just recently added ability to join groups based on age, gender, location, family status etc. This feature shows a lot of potential to allow customizable user groups based on web 3.0 principals, though it is not there yet.

Scoreboard: Other than commiserating with your support group, Finicity has no official scorecard that we found.

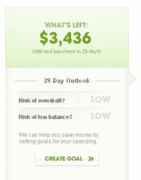

Overview: Quicken online is simple and basically provides the expected functionality, though one main feature stands out. This website is the most advanced so far when it comes to future forecasting. It has a “spending money outlook” that tracks your spending habits with a personalized web 3.0 approach to give you a clear view of where your money will be going two months down the line.

Future Forecasting: FANTASTIC! This software allows you to enter your monthly bills and your paycheck amounts. It then makes assumptions about your spending habits (based on previous spending) to show you if you’re likely to have more money next month or less. This is what web 3.0 is all about.

Education: Quicken basically does what all the other sites do by showing your transactions and breaking them into a pie chart of categories. It does have one stand out feature that tells you on your opening page what your chances of overdraft are.

Support Groups: None so far.

Scoreboard: None so far.

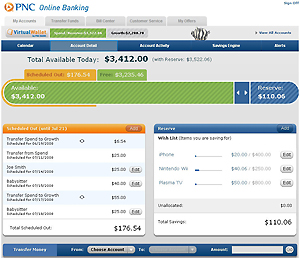

Overview: Being an East Coast regional bank, PNC is the only bank we were not able to get an account with to test out. But from what we can tell online, PNC’s Virtual Wallet doesn’t feel like a traditional money management site. As the name suggests, it makes banking feel much more intuitive and tactile. PNC hired design firm IDEO to make their site appeal to Gen Y users. They’ve made it extremely simple and incorporated playful surprise elements like “Punch the Pig,” a piggy bank that pops up and allows you to set aside money on the fly by clicking on it.

Future Forecasting: PNC doesn’t offer much future forecasting, although it does allow you to create a “Wish List” of items you want to save up for, with a progress meter showing how close you are to reaching your goal.

Education: PNC has taken a very visual approach to checking your current status of cash flow. They introduced a sliding Money Bar that is divided into three sections: Spend, Reserve and Growth. This lets you know where your money is going and gives you immediate control of it through a simple slide.

Support Groups: Surprisingly for a bank targeting Gen Y customers, there were no support groups that we could find.

Scoreboard: None so far.

This segment is part 3 in the series : Redesign That: Online Personal Finance

1 2 3 4 5 6 7

Featured Videos

Can 1M/1M Help Me Raise Money?

How Does 1M/1M Democratize Entrepreneurship Education?

How Does 1M/1M Democratize Management Consulting?

When Is The Right Time To Join 1M/1M?

Can 1M/1M Help Me With Business Development?

Can 1M/1M Help Me With Market Sizing?

Can 1M/1M Help Me Validate My Product?

Will I Have Private 1-on-1 Sessions In 1M/1M?

How Does 1M/1M Help Entrepreneurs Connect With Silicon Valley?

Mentoring or Consulting?

Why Does 1M/1M Charge $1000 a Year?

Why Does 1M/1M Partner With Local Organizations?

Why Don\’t Mentoring Networks Work?

Why Is It Important To Study With 1M/1M Now?

Dan Stewart Story

Vikrant Mathur Story