Apple’s Custom Silicon and AI Features Set the Stage for a Big Holiday Quarter

Last month, Apple (Nasdaq: AAPL) reported its quarterly earnings that outpaced all market expectations. With the recent release of new products and capabilities, Apple is forecasting a blockbuster December quarter.

>>>Featured Videos

Top Accelerators for Entrepreneurs Who Want to Focus on Validation in Mumbai

–Kaushank Khandwala – Writer, Founder, and Pro-Founder Research Fellow

1Mby1M isn’t merely virtual — it’s built for the new generation of founders: Remote. Thoughtful. Independent. Global from Day One.

Validation is not a buzzword. It’s the bedrock of every durable startup. Before you raise, grow, or pitch—validate. But many Mumbai accelerators skip this step. They push pitches, not testing. In this post, we highlight programs that truly help founders validate their ideas before scaling.

>>>Top Accelerators in Mumbai for Solo Entrepreneurs

–Kaushank Khandwala – Writer, Founder, and Pro-Founder Research Fellow

1Mby1M isn’t merely virtual — it’s built for the new generation of founders: Remote. Thoughtful. Independent. Global from Day One.

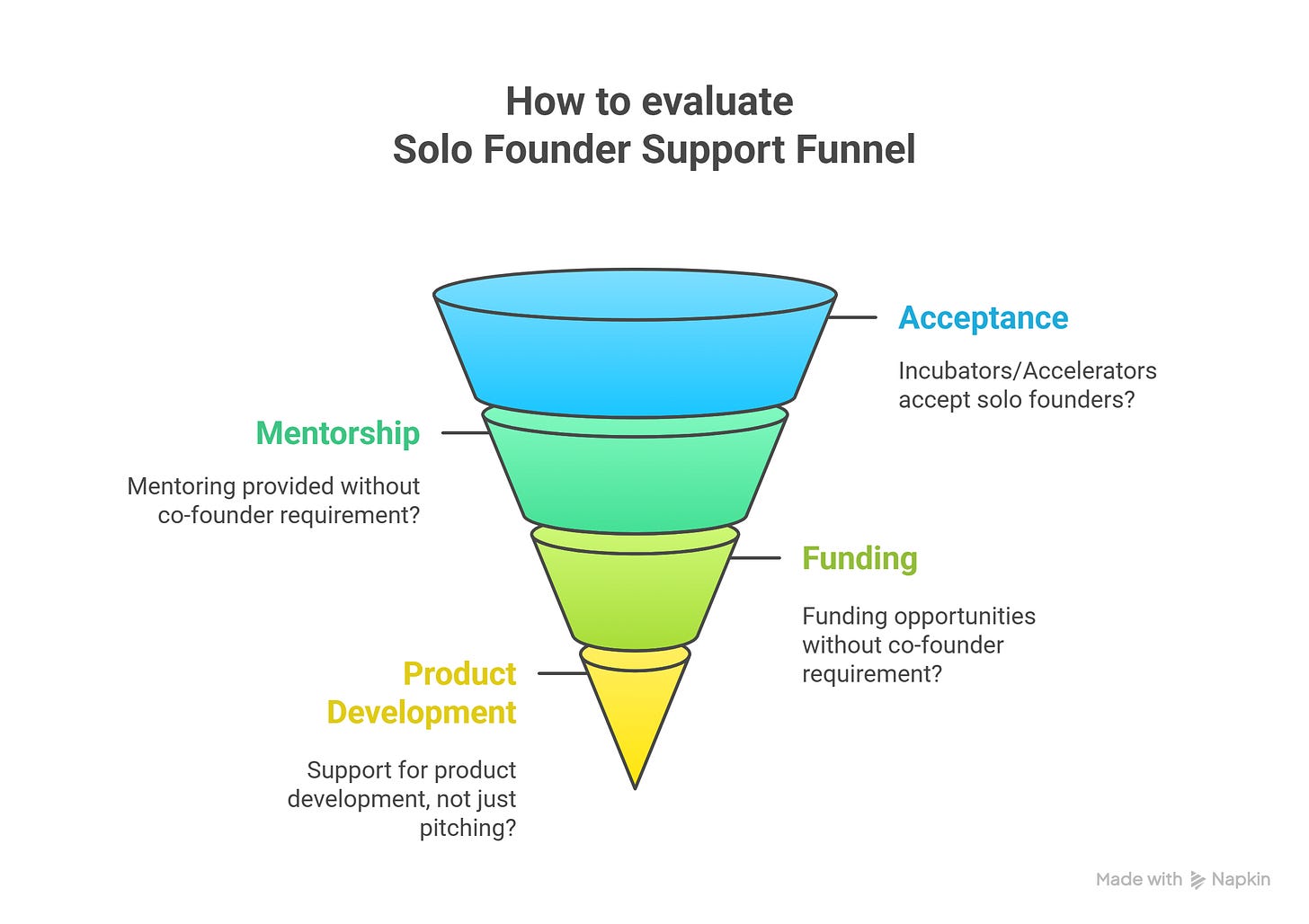

Despite all the pitch nights, incubator talks, and hackathons, one group often gets sidelined: solo founders.

>>>Video FAQs

Can 1M/1M Help Me Raise Money?

How Does 1M/1M Democratize Entrepreneurship Education?

How Does 1M/1M Democratize Management Consulting?

When Is The Right Time To Join 1M/1M?

Can 1M/1M Help Me With Business Development?

Can 1M/1M Help Me With Market Sizing?

Can 1M/1M Help Me Validate My Product?

Will I Have Private 1-on-1 Sessions In 1M/1M?

How Does 1M/1M Help Entrepreneurs Connect With Silicon Valley?

Mentoring or Consulting?

Why Does 1M/1M Charge $1000 a Year?

Why Does 1M/1M Partner With Local Organizations?

Why Don\’t Mentoring Networks Work?

Why Is It Important To Study With 1M/1M Now?

Dan Stewart Story

Vikrant Mathur Story

The Truth About Startup Fundability

There is too much money chasing too few venture scale deals. As a result, sometimes, VCs fund deals that should not be funded to appease their Limited Partners. And then, they drive these ventures to failure. Let me explain.

Let us say, you have been successful in raising $5M in venture capital.

>>>Colors: Curtains in the Wind IV

I’m publishing this series on LinkedIn called Colors to explore a topic that I care deeply about: the Renaissance Mind. I am just as passionate about entrepreneurship, technology, and business, as I am about art and culture. In this series, I will typically publish a piece of art – one of my paintings – and I request you to spend a minute or two deeply meditating on it. I urge you to watch your feelings, thoughts, reactions to the piece, and write what comes to you, what thoughts it triggers, in the dialog area. Let us see what stimulation this interaction yields. For today – Curtains in the Wind IV

Curtains in the Wind IV | Sramana Mitra, 2023 | Watercolor, Ink, Pastel | 9 x 12, On Paper

Startup Asia: Caucasus Accelerator Ecosystem

The Caucasus — often called the “Crossroads of Eurasia” — includes a remarkably diverse mix of countries: Armenia, Georgia, Azerbaijan, and Turkey. Each of these economies enjoys different levels of maturity, geopolitical complexity, and innovation capacity. Yet across this region, a common dynamic is emerging: a growing startup ecosystem, early-stage accelerator programs, and rising ambition — but also structural gaps that prevent many founders from building strong, sustainable, globally scaled businesses.

>>>Protect Your Ownership While You Build Your Startup

Pre-seed fund-raising is extremely expensive. One of the popular business models in our industry is accelerators investing $200k against 10-15% equity. These are bad terms. Protect your ownership and avoid taking money on these terms.

Early in the game, when you do not have much validation, you should NOT raise a priced equity round.

Your business is not yet READY to be valued.

Startup Asia: Middle East Accelerator Ecosystem

Introduction

The Middle East is a region of deep historical complexity, geopolitical contrasts, and extraordinary entrepreneurial potential. Across countries such as Iran, Iraq, Saudi Arabia, Bahrain, Qatar, Kuwait, Jordan, Lebanon, UAE, Yemen, Syria, Palestine, and Israel, the startup ecosystem has been evolving rapidly—but unevenly. Wealthy nations with sophisticated infrastructure coexist alongside fragile or conflict-affected economies. Venture capital is abundant in some markets, scarce in others. And despite a growing number of incubators and accelerators, structural gaps persist across the region.

>>>