Seed Capital

The Accelerator Conundrum: Navigating Your Path to Startup Success

The Accelerator Conundrum is a multipart series that challenges the prevailing wisdom of the tech startup ecosystem that entrepreneurs should Blitzscale out of the gate. Written by Sramana Mitra, the Founder and CEO of One Million by One Million (1Mby1M), the world’s first global virtual accelerator, it emphatically argues that a better strategy is to Bootstrap First, Raise Money Later, focus on customers, revenues and profits. 1Mby1M’s mission is to help a Million entrepreneurs reach a million dollars in annual revenue and beyond. Sramana’s Digital Mind AI Mentor virtually mentors entrepreneurs around the world in 57 languages. Try it out!

Alright, let’s cut through the noise and get to the brutal truth of the startup accelerator world. Many entrepreneurs, starry-eyed and naive, leap headfirst into 3-month accelerator programs without truly understanding the long-term implications. It’s time for an incisive commentary, a necessary dissection.

>>>1Mby1M Udemy Courses with Sramana Mitra: Financing

Raising money to build a startup is a huge challenge. To be able to raise any money at all, you must first understand how investors think. We have developed the following courses catering to entrepreneurs in different stages of their entrepreneurial journey.

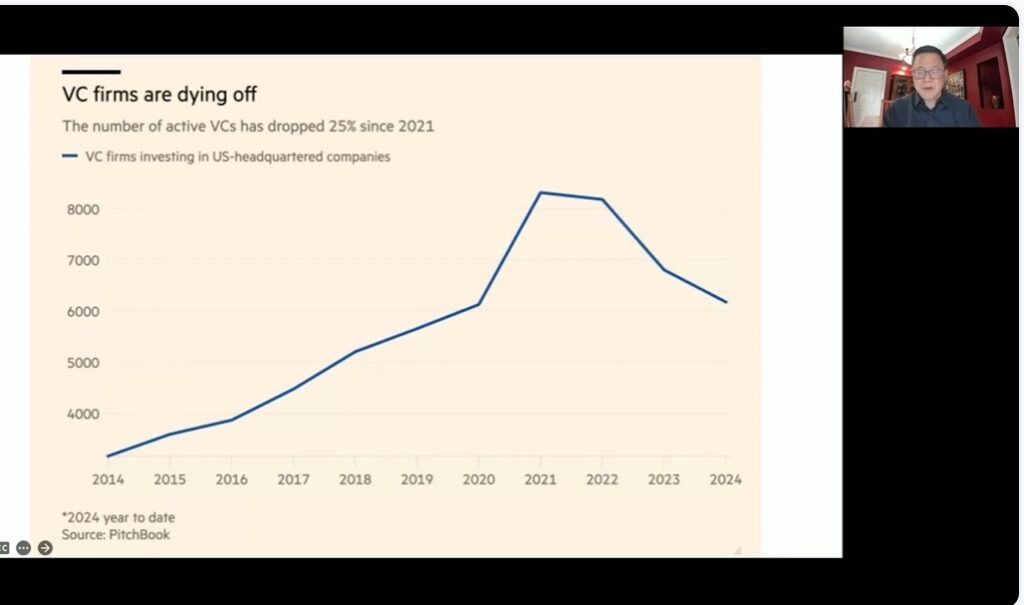

>>>1Mby1M Virtual Accelerator AI Investor Forum: Investor Gus Tai on VC Industry Size (Part 1)

Gus Tai is a veteran Venture Capitalist and a close friend. We discuss why the Venture Capital or VC industry size needs to shrink.

>>>Featured Videos

Can 1M/1M Help Me Raise Money?

How Does 1M/1M Democratize Entrepreneurship Education?

How Does 1M/1M Democratize Management Consulting?

When Is The Right Time To Join 1M/1M?

Can 1M/1M Help Me With Business Development?

Can 1M/1M Help Me With Market Sizing?

Can 1M/1M Help Me Validate My Product?

Will I Have Private 1-on-1 Sessions In 1M/1M?

How Does 1M/1M Help Entrepreneurs Connect With Silicon Valley?

Mentoring or Consulting?

Why Does 1M/1M Charge $1000 a Year?

Why Does 1M/1M Partner With Local Organizations?

Why Don\’t Mentoring Networks Work?

Why Is It Important To Study With 1M/1M Now?

Dan Stewart Story

Vikrant Mathur Story

1Mby1M Virtual Accelerator AI Investor Forum: Yanev Suissa, SineWave Ventures (Part 1)

Yanev Suissa, Managing Partner and Founder at SineWave Ventures, discusses changes in Venture Capital and his firm’s investment thesis.

>>>1Mby1M Virtual Accelerator AI Investor Forum: Daniel Ibri, Mindset Ventures (Part 1)

Daniel Ibri is Co-founder and Managing Partner at Mindset Ventures. This is an excellent discussion about the changing dynamics of AI and venture capital.

>>>1Mby1M Virtual Accelerator AI Investor Forum: Mohanjit Jolly, Partner at Iron Pillar (Part 1)

Mohanjit Jolly, Partner at Iron Pillar, discusses his firm’s growth stage investment thesis.

>>>1Mby1M Virtual Accelerator AI Investor Forum: Sandeep Sardana, BluePointe Ventures (Part 1)

Sandeep Sardana, Founder and General Partner at BluePointe Ventures, discusses his firm’s vertical AI investment thesis.

>>>1Mby1M Virtual Accelerator AI Investor Forum: Ihar Mahaniok, Geek Ventures (Part 1)

Ihar Mahaniok is Managing Partner at Geek Ventures. We have an excellent discussion on AI trends and startup opportunities.

>>>1Mby1M Virtual Accelerator AI Investor Forum: JP Persico, shuckerVC (Part 1)

Jean-Philippe ‘JP’ Persico, Cofounder and Managing Partner at shuckerVC, discusses his firm’s investment thesis.

>>>1Mby1M Virtual Accelerator AI Investor Forum: Marina and Nick Davidov, DVC (Part 1)

Marina and Nick Davidov are Cofounders and Managing Partners at DVC, a firm that backs only repeat founders doing AI startups. We had a terrific conversation on cutting edge issues within the AI ecosystem.

>>>1Mby1M Virtual Accelerator AI Investor Forum: Vinit Bhansali, Takshil Venture Partners (Part 1)

Vinit Bhansali, Founder and General Partner at Takshil Venture Partners, discusses how his firm is investing in India.

>>>1Mby1M Virtual Accelerator AI Investor Forum: Alex Benik, Encoded Ventures (Part 1)

Alex Benik, Partner/Founder at Encoded Ventures, discusses the fund’s investment thesis. Great discussion on how we each view the disruptions AI is causing on multiple fronts. VCs investing today have to think about the next 5-7 year window and what changes are likely to come.

>>>Investor Introductions For Entrepreneurs Outside Silicon Valley

Can I get introductions to relevant investors, customers, or partners—even if I’m not in Silicon Valley?

Yes, 1Mby1M does facilitate introductions to relevant investors, customers, and partners, even for entrepreneurs outside Silicon Valley. Here’s a breakdown:

>>>1Mby1M Virtual Accelerator AI Investor Forum: Ray Wu, Alumni Ventures AI Fund (Part 1)

Ray Wu, Managing Partner at Alumni Ventures AI Fund, discusses the fund’s investment thesis.

>>>1Mby1M Virtual Accelerator AI Investor Forum: Amir Kabir, Overlook Ventures (Part 1)

Amir Kabir, Founding Partner at Overlook Ventures, discusses his new firm’s investment Thesis around Risk. In addition, we had a great discussion on what younger aspiring entrepreneurs should do: jump into entrepreneurship right away, or learn a domain in a job.

>>>1Mby1M Virtual Accelerator AI Investor Forum: David Evans, Sentiero Ventures (Part 1)

David Evans, Managing Partner at Sentiero Ventures, discusses his firm’s AI investment thesis.

>>>Start With Customers Not Investors

For our Seed Capital series of podcasts, I’ve interviewed hundreds of investors, especially micro-VCs and angels who play an important role in the early-stage game. The toughest round of funding an entrepreneur will seek to raise is Pre-seed. How do you increase your odds?

Pre-seed has the lowest probability of success. Over 99% of the entrepreneurs who seek financing are rejected.

So, my humble advice to all entrepreneurs: please learn to assess your own probability of getting funded.