Seed Capital

1Mby1M Udemy Courses with Sramana Mitra: Financing

Raising money to build a startup is a huge challenge. To be able to raise any money at all, you must first understand how investors think. We have developed the following courses catering to entrepreneurs in different stages of their entrepreneurial journey.

>>>180th 1Mby1M Entrepreneurship Podcast With Alain le Loux, Cottonwood Technology Fund

Alain le Loux is General Partner at Cottonwood Technology Fund. The firm invests in hardcore technology startups in Northern Europe and the South West of United States.

Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | Google Play | Stitcher | TuneIn | RSS

Featured Videos

Can 1M/1M Help Me Raise Money?

How Does 1M/1M Democratize Entrepreneurship Education?

How Does 1M/1M Democratize Management Consulting?

When Is The Right Time To Join 1M/1M?

Can 1M/1M Help Me With Business Development?

Can 1M/1M Help Me With Market Sizing?

Can 1M/1M Help Me Validate My Product?

Will I Have Private 1-on-1 Sessions In 1M/1M?

How Does 1M/1M Help Entrepreneurs Connect With Silicon Valley?

Mentoring or Consulting?

Why Does 1M/1M Charge $1000 a Year?

Why Does 1M/1M Partner With Local Organizations?

Why Don\’t Mentoring Networks Work?

Why Is It Important To Study With 1M/1M Now?

Dan Stewart Story

Vikrant Mathur Story Download" class="hvideo iframe playbut videow" id="playbg" href="http://www.youtube.com/embed/a> ?rel=0&autoplay=1"> Download Android " class="hvideo iframe playbut videow" id="playbg" href="http://www.youtube.com/embed/a> ?rel=0&autoplay=1"> Android

179th 1Mby1M Entrepreneurship Podcast With Luis Gutierrez Roy, Telegraph Hill Capital

Luis Gutierrez Roy, Managing General Partner of Telegraph Hill Capital, discusses his firms’ investment thesis. The fund provides Spanish Limited Partners access to investment opportunities in the US and Europe.

Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | Google Play | Stitcher | TuneIn | RSS

449th Roundtable Recording on July 11, 2019

In case you missed it, you can listen to the recording of this roundtable here:

Roundtable Recap: July 11 – Niche Expertise Can Be Turned Into Excellent Small Businesses

During this week’s roundtable, we had one entrepreneur pitch, and a lengthy discussion around a very niche business that I found very promising as a viable small business. It’s an interesting case study of how niche expertise can be turned into great small business.

Mid-Atlantic Amateur Radio

Pete Young from Thurmont, Maryland pitched the Mid-Atlantic Amateur Radio Service, a repair service for old ham radios.

You can listen to the recording of this roundtable, especially if you are working on a niche idea, here:

1Mby1M Virtual Accelerator Investor Forum: With Eghosa Omoigui of EchoVC Partners (Part 1)

Responding to a popular request, we are now sharing transcripts of our investor podcast interviews in this new series. The following interview with Eghosa Omoigui was recorded in May 2019.

Eghosa Omoigui is Managing Partner at EchoVC Partners, a firm focused on the African market. This is a fascinating discussion about African startups and venture capital.

Sramana Mitra: Let’s get to know each other. Tell us about EchoVC. Tell us about yourself.

>>>448th 1Mby1M Entrepreneurship Podcast With Nnamdi Okike, 645 Ventures

Nnamdi Okike is Co-founder and Managing Partner at 645 Ventures. We have an excellent conversation about trends and his firm’s investment thesis.

Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | Google Play | Stitcher | TuneIn | RSS

1Mby1M Virtual Accelerator Investor Forum: With Vikas Choudhury of Pivot Ventures (2)

Sramana Mitra: Let’s talk about some of the things you’ve invested in. We’ll talk about Pivot Ventures investments in a moment. You said you’re one of the first angel investors in the Indian ecosystem.

Talk a little bit about what you invested in 2005. How has that landscape changed? How has your investment evolved through that period?

>>>1Mby1M Virtual Accelerator Investor Forum: With Vikas Choudhury of Pivot Ventures (Part 1)

Responding to a popular request, we are now sharing transcripts of our investor podcast interviews in this new series. The following interview with Vikas Choudhury was recorded in May 2019.

Vikas Choudhury is Managing Partner at Pivot Ventures and President at Reliance Jio. He is one of the earliest Angel investors in India and invested in early successes like InMobi and Myntra. We discuss the evolution of the Indian startup and venture capital industry.

Sramana Mitra: Let’s start by introducing our audience to yourself as well as to both your activities.

>>>447th Roundtable Recording on June 20, 2019: With Victoire Laurenty, Kerala Ventures

In case you missed it, you can listen to the recording of this roundtable here:

1Mby1M Virtual Accelerator Investor Forum: With Cristobal Perdomo of Jaguar Ventures (Part 1)

Responding to a popular request, we are now sharing transcripts of our investor podcast interviews in this new series. The following interview with Cristobal Perdomo was recorded in May 2019.

Cristobal Perdomo is Co-Founder and General Partner at Jaguar Ventures, a venture fund that invests in Latin America.

Sramana Mitra: Let’s get to know you. Tell us about yourself as well as Jaguar Ventures. What do you like to invest in? What sized funds are you working with?

>>>1Mby1M Virtual Accelerator Investor Forum: With Shripati Acharya of Prime Venture Partners (Part 1)

Responding to a popular request, we are now sharing transcripts of our investor podcast interviews in this new series. The following interview with Shripati Acharya was recorded in April 2019.

Shripati Acharya is Managing Partner at Priven Advisors, advising Prime Venture Partners, a firm focused on core technology ventures in India. Unlike most VCs, Prime does do concept-stage investments.

Sramana Mitra: Let’s get acquainted. Let’s get our audience introduced to you as well as to Prime.

>>>448th Roundtable Recording on June 27, 2019: With Nnamdi Okike, 645 Ventures

In case you missed it, you can listen to the recording here:

Roundtable Recap: June 27 – Startup Trends Discussion with Nnamdi Okike, 645 Ventures

During this week’s roundtable, we had as our guest Nnamdi Okike, Co-founder and Managing Partner at 645 Ventures. Excellent conversation about trends and his firm’s investment thesis.

Rigava Solar

As for the entrepreneur pitch session, we first had Arun Joshi from Haryana, India, pitch Rigava Solar, a solar systems integration firm.

Serve Community

Then Matt Turner from Alameda, California, pitched Serve Community, a gamified app for volunteering for non profits. Great concept!

1Mby1M Virtual Accelerator Investor Forum: With Michael Smerklo of Next Coast Ventures (Part 1)

Responding to a popular request, we are now sharing transcripts of our investor podcast interviews in this new series. The following interview with Michael Smerklo was recorded in April 2019.

Michael Smerklo, Co-Founder and Managing Director at Next Coast Ventures, talks about some of the ventures his firm has invested in and the philosophy in general.

Sramana Mitra: Let’s start by getting to know you and introducing you to our audience. Tell us a bit about yourself as well as about Next Coast.

>>>1Mby1M Virtual Accelerator Investor Forum: With Sarbvir Singh of WaterBridge Ventures (Part 1)

Responding to a popular request, we are now sharing transcripts of our investor podcast interviews in this new series. The following interview with Sarbvir Singh was recorded in April 2019.

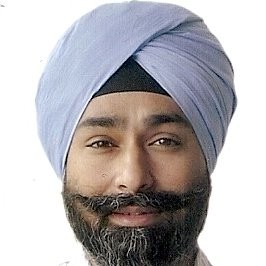

Sarbvir Singh, Managing Partner at WaterBridge Ventures, talks about the firm’s India-focused investment thesis.

Sramana Mitra: Tell us about WaterBridge Ventures. What are your activities? Where are you positioning this fund? How big is this fund?

>>>