Seed Capital

1Mby1M Udemy Courses with Sramana Mitra: Financing

Raising money to build a startup is a huge challenge. To be able to raise any money at all, you must first understand how investors think. We have developed the following courses catering to entrepreneurs in different stages of their entrepreneurial journey.

>>>1Mby1M Virtual Accelerator Investor Forum: With Kelly Perdew of Moonshots Capital (Part 1)

Responding to a popular request, we are now sharing transcripts of our investor podcast interviews in this new series. The following interview with Kelly Perdew was recorded in June 2018.

Kelly Perdew is Co-founder and Managing General Partner at Moonshots Capital, a firm that has a unique investment thesis of supporting military veterans. Very interesting insights.

Sramana Mitra: Let’s start by having you share a little bit about your background as well as the background of your fund. What is the investing focus? How big is the fund? What kind of investments are you making? >>>

Featured Videos

Can 1M/1M Help Me Raise Money?

How Does 1M/1M Democratize Entrepreneurship Education?

How Does 1M/1M Democratize Management Consulting?

When Is The Right Time To Join 1M/1M?

Can 1M/1M Help Me With Business Development?

Can 1M/1M Help Me With Market Sizing?

Can 1M/1M Help Me Validate My Product?

Will I Have Private 1-on-1 Sessions In 1M/1M?

How Does 1M/1M Help Entrepreneurs Connect With Silicon Valley?

Mentoring or Consulting?

Why Does 1M/1M Charge $1000 a Year?

Why Does 1M/1M Partner With Local Organizations?

Why Don\’t Mentoring Networks Work?

Why Is It Important To Study With 1M/1M Now?

Dan Stewart Story

Vikrant Mathur Story

1Mby1M Virtual Accelerator Investor Forum: With Kerry Rupp of True Wealth Ventures (Part 1)

Responding to a popular request, we are now sharing transcripts of our investor podcast interviews in this new series. The following interview with Kerry Rupp was recorded in October 2018.

Kerry Rupp, Partner at True Wealth Ventures, discusses their women-focused investment thesis.

Sramana Mitra: Let’s get you introduced to our audience. Tell us about your investing focus. What is the size of the fund? What sized checks are you writing?

Kerry Rupp: True Wealth Ventures fund one is approximately $20 million. We’re typically focused on women-led companies, which we define as >>>

1Mby1M Virtual Accelerator Investor Forum: With Biplab Adhya and Venu Pemmaraju of Wipro Ventures (Part 1)

Responding to a popular request, we are now sharing transcripts of our investor podcast interviews in this new series. The following interview with Milos Sochor was recorded in June 2018.

Biplab Adhya and Venu Pemmaraju are Co-Heads of Wipro Ventures.

Sramana Mitra: Tell us a bit about yourselves as well as Wipro Ventures. Let’s introduce our audience to the investment activities of Wipro Ventures. >>>

1Mby1M Virtual Accelerator Investor Forum: With Milos Sochor of Y Soft Ventures (Part 1)

Responding to a popular request, we are now sharing transcripts of our investor podcast interviews in this new series. The following interview with Milos Sochor was recorded in September 2018.

Milos Sochor is Managing Partner at Y Soft Ventures, a firm in the Czech Republic. Fascinating conversation about how a small region is gradually becoming a powerhouse of innovation and entrepreneurship.

Sramana Mitra: Tell us a little bit about Y Soft. How big is the fund? Tell us about your investing focus. What kind of investments do you make? Let’s get you introduced to our audience. >>>

1Mby1M Virtual Accelerator Investor Forum: With Ravi Mohan of Shasta Ventures (Part 1)

Responding to a popular request, we are now sharing transcripts of our investor podcast interviews in this new series. The following interview with Ravi Mohan was recorded in June 2018.

Ravi Mohan is Managing Director at Shasta Ventures, a firm that has invested in three SaaS Unicorns. Ravi discusses these investments: Apptio, Anaplan, and Zuora.

Sramana Mitra: Let’s start by introducing our audience to you and to Shasta. Tell us a bit about your background. As we are sitting in 2018, what is Shasta’s investment focus? >>>

1Mby1M Virtual Accelerator Investor Forum: With Ankit Jain of Gradient Ventures (Part 1)

Responding to a popular request, we are now sharing transcripts of our investor podcast interviews in this new series. The following interview with Ankit Jain was recorded in May 2018.

Ankit Jain is Founding Partner at Gradient Ventures, Google’s AI venture fund.

Sramana Mitra: Let’s introduce you to our audience. Tell us about yourself a bit and introduce us to Gradient Ventures. What is the focus of the fund? How big is the fund?

Ankit Jain: Gradient Ventures is Google’s AI-focused early-stage venture fund. We invest $1 million to $10 million in companies that >>>

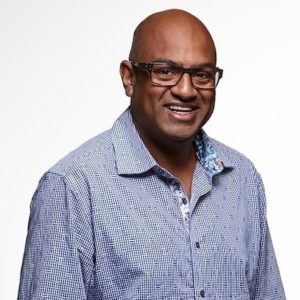

419th 1Mby1M Entrepreneurship Podcast With Ray Chan, K5 Ventures

Ray Chan, Managing Director at K5 Ventures and Tech Coast Angels, shares his views on the segments his firms invest in.

Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | Google Play | Stitcher | TuneIn | RSS

418th 1Mby1M Entrepreneurship Podcast With Shuly Galili, UpWest Labs

Shuly Galili, Founding Partner, UpWest Labs, talks to us about pre-seed and seed investments in the Israel – Silicon Valley corridor.

Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | Google Play | Stitcher | TuneIn | RSS

419th Roundtable Recording on October 17, 2018: With Ray Chan, K5 Ventures

In case you missed it, you can listen to the recording here:

Roundtable Recap: October 17 – Cool Companies, Exciting Opportunities

During this week’s roundtable, we had as a guest Ray Chan, Managing Director at K5 Ventures and Tech Coast Angels shared his views on the segments his firms invest in.

Locol

As for pitching, we had Sriniva Nag Mandali from Hyderabad, India, pitched Locol, a flexible fleet access solution for tour operators and municipal governments a la Uber, but in a B-to-B context. Very cool!

ViaMaan

Next, Rahul Sharma from Bangalore, India, pitched ViaMaan, an aerial cargo delivery solution. Also very cool.

1Mby1M Virtual Accelerator Investor Forum: With Utsav Somani of AngelList India (Part 1)

Responding to a popular request, we are now sharing transcripts of our investor podcast interviews in this new series. The following interview with Utsav Somani was recorded in May 2018.

Utsav Somani, Angel Investor at AngelList India, talks about the newly launched AngelList India.

Sramana Mitra: Tell us about the investing focus of AngelList in India. How are you operating? How is it structured? How is it different from the mother ship? >>>

418th Roundtable Recording on October 11, 2018: With Shuly Galili, UpWest Labs

In case you missed it, you can listen to the recording here:

Roundtable Recap: October 11 – Global Startup Acceleration Networks are Growing

During this week’s roundtable, we had as a guest Shuly Galili, Founding Partner, UpWest Labs, who talked to us about pre-seed and seed investments in the Israel – Silicon Valley corridor.

Sensfix

As for pitching, we had Balaji Renukumar from Palo Alto, California, pitching Sensfix, an IOT-based venture addressing the repair and maintenance of street lights and other infrastructure assets. Very cool company, and a great example of how various eco-systems are collaborating to produce new startups. This one has been accelerated in India and in Amsterdam, before showing up in Palo Alto.

We also discussed our new partnership with EIT Health to accelerate over 100 European Startups. More on this coming soon.

1Mby1M Virtual Accelerator Investor Forum: With Kanwaljit Singh of Fireside Ventures (Part 1)

Responding to a popular request, we are now sharing transcripts of our investor podcast interviews in this new series. The following interview with Kanwaljit Singh was recorded in May 2018.

Kanwaljit Singh is Founder of Fireside Ventures, a fund focused on building consumer brands in India. This is an excellent conversation about the nascent opportunity that, I expect, will be a major, worldwide phenomenon in the coming years.

Sramana Mitra: Let’s start by introducing our audience to you as well as to your fund. Tell us a bit about your investing focus. How big is the fund? What kind of investments do you like to make? >>>

417th 1Mby1M Entrepreneurship Podcast With Miriam Rivera, Ulu Ventures

Miriam Rivera, Partner at Ulu Ventures, a firm committed to diversity as its core investment philosophy.

Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | Google Play | Stitcher | TuneIn | RSS