Seed Capital

1Mby1M Virtual Accelerator Investor Forum: With Ravi Mohan of Shasta Ventures (Part 2)

Sramana Mitra: Just to complete that configuration question, because of our activities being global, we see companies everywhere. We see companies all over the United States. We companies in Europe. Many of them have aspirations of coming to Silicon Valley and set up their go-to market operation.

Maybe they do validation elsewhere, but they go beyond the validation phase in Silicon Valley. Is that something you’re seeing? I’m sure you’re seeing India but are you also seeing Silicon Valley go-to market but backend in other parts of the United States?

Ravi Mohan: Very much so. I do think that the business of creating technology startups that disrupt the status quo is a global business. You can >>>

1Mby1M Virtual Accelerator Investor Forum: With Ravi Mohan of Shasta Ventures (Part 1)

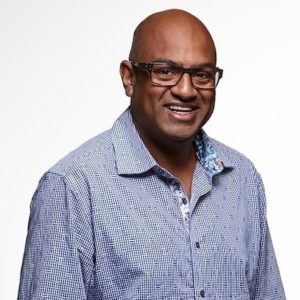

Responding to a popular request, we are now sharing transcripts of our investor podcast interviews in this new series. The following interview with Ravi Mohan was recorded in June 2018.

Ravi Mohan is Managing Director at Shasta Ventures, a firm that has invested in three SaaS Unicorns. Ravi discusses these investments: Apptio, Anaplan, and Zuora.

Sramana Mitra: Let’s start by introducing our audience to you and to Shasta. Tell us a bit about your background. As we are sitting in 2018, what is Shasta’s investment focus? >>>

1Mby1M Virtual Accelerator Investor Forum: With Ankit Jain of Gradient Ventures (Part 6)

Sramana Mitra: It’s fascinating, isn’t it? It’s a really exciting field. Are you chasing unicorns?

Ankit Jain: Given that we’re investing $1 million to $10 million, we’re looking at a lot of companies that we hope will show their true market potential. We hope some of them get to that stage. We strongly believe many of them will get there.

Sramana Mitra: AI, as you said, is applicable to every domain. If you understand the tools of AI, you can apply it in creative ways to solve problems in every single vertical. Not all of these are billion-dollar TAM opportunities. Some of them are specialized. How do you parse these opportunities? >>>

1Mby1M Virtual Accelerator Investor Forum: With Ankit Jain of Gradient Ventures (Part 5)

Sramana Mitra: In the case of Algorithmia, what kinds of use cases are they? It sounds like it’s a horizontal platform that could be applied to all sorts of use cases. You said it’s a Fortune 500 target market. What kinds of use cases are they going after?

Ankit Jain: The simplest way to describe Algorithmia is in the context of a company that has hundreds of algorithm developers. There’s a lot of companies that are doing this, especially in banking and finance where different people are trying out different models. That institutional knowledge doesn’t get shared across a company.

Often, in companies that have internal code-sharing infrastructure, everyone publishes their code on GitHub. Let’s say you and I work at >>>

1Mby1M Virtual Accelerator Investor Forum: With Ankit Jain of Gradient Ventures (Part 3)

Sramana Mitra: I was talking to a friend at a party last weekend. He’s very experienced and successful serial entrepreneur. He has invested in an AI company that is doing very well. But this question of hiring AI talent is very serious right now. Let me ask you the geography question. What is your footprint? Where do you like to invest?

Ankit Jain: Before we get to that, let’s go back to the recruiting point because I think it’s a very important point. Valley folklore and reality has been that the best companies are built with the best people. If it’s okay with you, we can spend a couple of minutes on the recruiting aspect. >>>

1Mby1M Virtual Accelerator Investor Forum: With Ankit Jain of Gradient Ventures (Part 2)

Sramana Mitra: Double-click down for me on your definition of early stage. You said check size is from $1 million to $10 million. What is your definition of early stage? What does an AI startup need to show to be able to convince you that is has enough validation that there is something there?

Ankit Jain: That’s a very interesting question. I wish I had a clear answer of, “These are the things that you need to convince any investor that you are fundable.” Every investor has his view on this. We have a few things that we look for. They change by the stage of the company. At the seed stage, we’re looking for a strong core team that we think can execute in a given market, what people would refer to as >>>

1Mby1M Virtual Accelerator Investor Forum: With Ankit Jain of Gradient Ventures (Part 1)

Responding to a popular request, we are now sharing transcripts of our investor podcast interviews in this new series. The following interview with Ankit Jain was recorded in May 2018.

Ankit Jain is Founding Partner at Gradient Ventures, Google’s AI venture fund.

Sramana Mitra: Let’s introduce you to our audience. Tell us about yourself a bit and introduce us to Gradient Ventures. What is the focus of the fund? How big is the fund?

Ankit Jain: Gradient Ventures is Google’s AI-focused early-stage venture fund. We invest $1 million to $10 million in companies that >>>

419th 1Mby1M Entrepreneurship Podcast With Ray Chan, K5 Ventures

Ray Chan, Managing Director at K5 Ventures and Tech Coast Angels, shares his views on the segments his firms invest in.

Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | Google Play | Stitcher | TuneIn | RSS