Seed Capital

1Mby1M Virtual Accelerator AI Investor Forum: Investor Gus Tai on VC Industry Size (Part 5)

Sramana Mitra: You raised two points I want to elaborate on briefly, especially as we near the end of our time. Human nature, as you noted, is status-seeking. Until now, status in entrepreneurship has been associated with venture-funded startups. Venture-backed founders are often seen as higher status than bootstrapped entrepreneurs, and the media has historically reinforced this bias.

In 2007, Sridhar came to see me and told me that no media outlet wanted to cover his company because he had not raised venture capital. I was stunned because it was an extraordinary story. I wrote the first piece on Zoho, followed by a major Forbes column, and that is how the world discovered Zoho. The media simply did not know how to evaluate a powerful bootstrapped entrepreneur.

>>>1Mby1M Virtual Accelerator AI Investor Forum: Investor Gus Tai on VC Industry Size (Part 4)

Sramana Mitra: Gus, that is a good segue into another class of venture capital firms in the market. Let’s set aside the 30 funds raising mega capital and doing mega deals.

>>>1Mby1M Virtual Accelerator AI Investor Forum: Investor Gus Tai on VC Industry Size (Part 3)

Sramana Mitra: This leads to another part of the discussion. As lavishly funded companies emerge, a parallel phenomenon has accelerated this year: this is also the golden age of bootstrapped startups.

People are accomplishing far more, far faster, with significantly fewer resources and less capital than ever before. We are seeing trends such as ultralight startups, solo entrepreneurship, and bootstrapped entrepreneurship gain real momentum.

>>>1Mby1M Virtual Accelerator AI Investor Forum: Investor Gus Tai on VC Industry Size (Part 2)

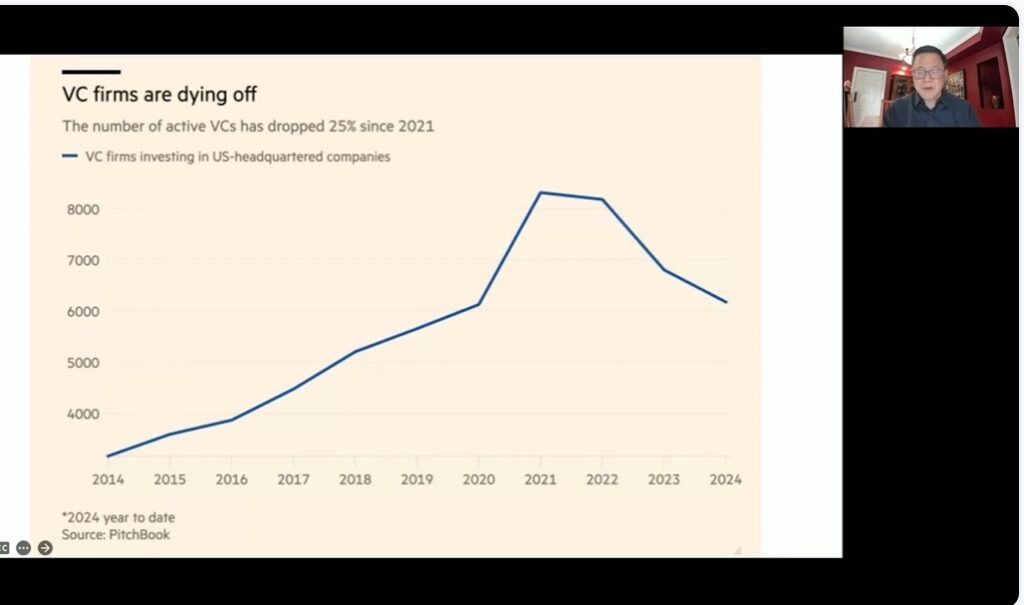

Sramana Mitra: One interesting point is that the peak occurs in 2021, which was the height of COVID. This was not a traditional boom time, yet the venture industry peaked in 2021 and 2022, during the pandemic.

Gus Tai: I would also like to comment on the next slide, and then we can move into the broader discussion. This chart complements the prior one and also comes from PitchBook. It shows the amount of capital being raised by venture firms, which peaked in 2022.

>>>1Mby1M Virtual Accelerator AI Investor Forum: Investor Gus Tai on VC Industry Size (Part 1)

Gus Tai is a veteran Venture Capitalist and a close friend. We discuss why the Venture Capital or VC industry size needs to shrink.

>>>1Mby1M Virtual Accelerator AI Investor Forum: Yanev Suissa, SineWave Ventures (Part 5)

Sramana Mitra: My thesis on agentic AI is exactly what we discussed earlier: solving specific problems with deep domain knowledge. The production systems that are getting real traction and generating significant revenue are those solving major enterprise problems.

A great case study is Autonomize. The health insurance authorization process still relies on fax machines. Autonomize digitized the process, added agents and automation, kept humans in the loop, and delivered massive efficiency gains. These are real production systems generating hundreds of thousands of dollars.

>>>1Mby1M Virtual Accelerator AI Investor Forum: Yanev Suissa, SineWave Ventures (Part 4)

Sramana Mitra: Yanni, you said you are investing in superintelligence. Tell me more about what you’ve invested in and your thesis on superintelligence.

>>>1Mby1M Virtual Accelerator AI Investor Forum: Yanev Suissa, SineWave Ventures (Part 3)

Sramana Mitra: Yeah. So, Yev, I want to make a point, and I want your thoughts on it.

We hear a lot from people saying, “This is just a wrapper on top of ChatGPT.” But there is a lot of domain knowledge in specific verticals that you can solve very well with a wrapper on top of ChatGPT, because the domain knowledge is where the real work is happening.

>>>