Smartphone Ecosystem (Part 2): Profitability

By guest author Nalini Kumar Muppala

So, what makes smartphone an attractive business to be in?

In short, smartphones, at least so far, have been a high-profit business. Consider Apple, RIM, and Nokia. While Apple and RIM are pure-play (as far as phones go) smartphone makers, Nokia makes phones that serve customers across the entire spectrum. All three provide services for their devices in the form of the App store, BlackBerry services, and the Ovi store respectively.

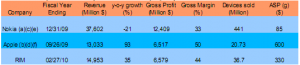

Performance at some major handset makers in the past fiscal year

(a) “Devices & Services” unit of Nokia.

(b) “iPhone and related services” at Apple.

(c) Exchange rate used is 1 EUR = 1.35 USD.

(d) Gross margin is an estimate.

(e) All devices including smartphones.

(f) Gross margin and ASP are estimates.

(g) ASP – average selling price of all phones from this vendor.

Results are for the latest fiscal year and thus the numbers do not compare well, but one can see the trend. Nokia sold nearly 441 million devices in 2009, producing revenue of €28 billion in its Devices & Services division at a profit margin of 33%. iPhones make up 15% of the total 175 million smartphone units sold in 2009. That puts Apple devices shipped in 2009 at 26.25 million. By Apple’s own accounting, 20.7 million iPhones were sold in fiscal 2009; the iPhone and related products and services raked in $13 billion in fiscal 2009 (93% growth over 2008).

Apple does not disclose profit margin for the iPhone, nor does it disclose the ASP of the devices it sells – the numbers in the above table are informed estimates at best. Gross margin at RIM fell slightly from 46% a year ago to 44%. ASP for Apple and RIM devices rose slightly (Needs updating from AR 2010). On the other hand, ASP for Nokia devices fell from approximately $100 in 2008 to $85 in 2009.

Notice how combined profit from iPhones, BlackBerry devices and related services rivals profit from all devices and services at Nokia! This is so in spite of Nokia’s market share being several times the size of Apple’s and RIM’s market shares.

The reason is that the above comparison is for “devices and services.” Handset sales account for a mere $160 billion out of a $1,070 billion in mobile industry revenues for 2009 (including voice and various data services). The smartphone business allows for profitable handsets and continued after sale revenue from services.

As the iPhone took off during 2008–2009, even market leaders had to retool their wares and prepare to compete in the new paradigm. BlackBerry devices evolved and became feature-rich. The pressure to match competition has meant increased R&D and component costs. Profitability is taking a hit at RIM while the company strives to maintain growth and keep its market share and improves its device offering to suit an ever more demanding consumer and while reaching down market. In the past three fiscal years (ending ~March 1), RIM revenues were $6 billion, $11 billion, and $15 billion and gross margins were 51.3%, 46.1%, and 44.1%, and device ASP slightly increased from $346 to $349 and then dropped to $330 in fiscal 2010. One cannot help but wonder if ASP at Apple will follow suit.

In the next post, we will look at design wins in some of the most popular smartphones and discuss the trends at chip makers.

This segment is part 2 in the series : Smartphone Ecosystem

1 2 3 4 5 6 7 8 9 10 11

Featured Videos

Can 1M/1M Help Me Raise Money?

How Does 1M/1M Democratize Entrepreneurship Education?

How Does 1M/1M Democratize Management Consulting?

When Is The Right Time To Join 1M/1M?

Can 1M/1M Help Me With Business Development?

Can 1M/1M Help Me With Market Sizing?

Can 1M/1M Help Me Validate My Product?

Will I Have Private 1-on-1 Sessions In 1M/1M?

How Does 1M/1M Help Entrepreneurs Connect With Silicon Valley?

Mentoring or Consulting?

Why Does 1M/1M Charge $1000 a Year?

Why Does 1M/1M Partner With Local Organizations?

Why Don\’t Mentoring Networks Work?

Why Is It Important To Study With 1M/1M Now?

Dan Stewart Story

Vikrant Mathur Story