Cadence Crashes. Now What?

Cadence (NASDAQ: CDNS) reported its Q4 results on January 30, 2008. The quarter’s revenue at $457.9 million showed a 6% year on year growth over $431.0 million reported the previous year and a 14% sequential growth (over $401 million Q3 revenue).

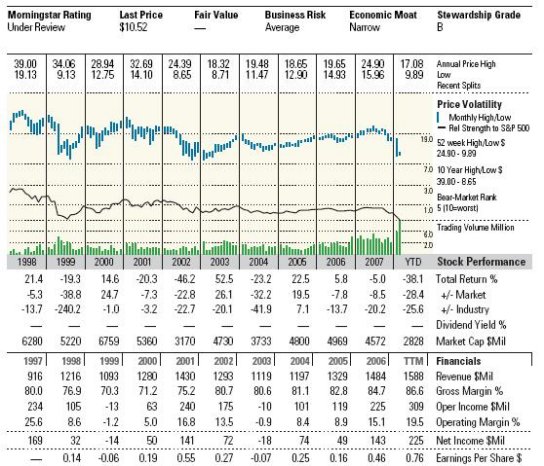

The stock took a major beating as Q4 revenue was below market expectations of $470.3 million. On January 31, the stock fell to a new 52 week low of $9.89 – a 53% erosion of market value from the previous day close of $15.16. It has since recovered marginally and closed at $10.69 with a market cap of $2.9 Billion, its lowest in the last decade, yesterday.

The market reacted to the bearish outlook provided for the new fiscal year. The projected Q1 revenue of $280 to $290 million and an EPS view of $0.03 to $0.05 is substantially lower than the market’s expectations of $393.2 million and EPS of $0.30. For the 2008 fiscal year, Cadence projected revenue at $1.49 billion to $1.54 billion with an EPS of $1.11 to $1.19, lower than analyst expectations of $1.74 billion and EPS of $1.53.

The company’s CFO, Bill Porter cited “Aggressive pricing environment” as a reason for the conservative estimates. To understand the competitive environment that Cadence is playing in, and the resultant “deal practices”, please read my prior EDA series: “Cadence: Buyout Rumors Persist”, “Synopsys Looks Healthy, But”, “Mentor Graphics: LBO Recommended”, and “Will Magma Die on the Vine?” While the price competition is an industry-wide issue, the EDA Card “all-you-can-eat” strategy that Cadence is following puts it at a competitive advantage versus smaller rivals Mentor and Magma. Only Synopsys can meaningfully compete with that strategy. So, my gut says that the competitive environment should favor Cadence, not hinder. I am not sure I understand what Bill is saying here.

Analysts are also concerned that revenues from “turns” (revenue on license renewals is recognized upfront), which make up 40% of the company’s revenues, will become harder to come by in case of a weak economy and a soft semiconductor market. This is a real concern.

The share volumes traded showed a substantial increase from 5.8 Million shares on January 30 to 53.5 Million on January 31. In the five trading sessions following the announcement of the results, 114.5 Million shares have been traded compared to the 22.4 Million shares traded in the five trading sessions prior to the announcement. Cadence is not used to such activity levels in its stock, and is perhaps burdened by the attention.

If you are an investor, what should you be doing?

Well, let’s finish taking a look at the numbers, first, and understanding more of the dynamics of the industry.

The $28 million settlement with the Internal Revenue Service relating to tax years 1997-1999 helped Cadence increase its net income to $119.5 million (26% of revenue) from previous year’s $48.4 million (11% of revenue) reporting a 147% increase. Diluted EPS on a non-GAAP basis stood at $0.46 compared to $0.38 for the year before (a 21% increase over the year) and $0.33 for Q3 (a 39% increase over the quarter).

Revenue for the year grew by 9% over $1.48 billion in fiscal 2006 to $1.62 billion in fiscal 2007. The net income for the fiscal year 2007 was $296 million compared to $143 million in the year 2006. Diluted EPS on a non-GAAP basis stood at $1.35 per share for the year 2007, compared to $1.08 per share in the year 2006. This is the most profitable Cadence has been in a long time. The question, however, remains: at what cost?

EDA is notoriously R&D heavy. Cutting R&D usually is tantamount to either cutting off future revenue, or betting on expensive acquisitions. The bigger issue is also that startup activity in EDA has gone down significantly, and venture capital has all but dried up. There may not be much to acquire when the need arises. This is a deeply concerning phenomenon, since the entire semiconductor industry is dependent on EDA to be able to achieve its innovation objectives, even though it doesn’t allow EDA to get enough value for its contribution, something Mike Fister, CEO of Cadence, has been trying to address, albeit not very successfully.

The truth is, innovation in chips has to go on. The chip industry and the EDA industry have to come to terms with each other, and find a sustainable balance. Unfortunately, Wall Street, a short term focused master, does not care about these sustainability issues. And EDA CEOs have no choice but to sing and dance to Wall Street’s tune, else their own personal compensations get jeopardized. Thus, Ray Bingham and Mike Fister, Cadence’s past and current CEOs have had little choice but to “follow the money”.

In the past, chips went to smaller nodes every couple of years, driving in a new version of EDA tools into custom shops. Not anymore. Things have become far too expensive, causing design starts to fall. The move to 65nm and 45nm has been much slower than those to 120nm and 90nm. EDA, meanwhile, has not delivered any breakthrough innovation that can actually “check” the cost of chip design in the lower node sizes via automation. The growing area is early verification, and Cadence’s Verisity acquisition has helped the company build up its verification business further.

In terms of Q4 numbers, revenues from Functional Verification increased sequentially from 20% to 26%, Systems Interconnect from 7% to 9% while Custom IC Design fell from 32% to 25%. Both Digital IC Design and Design for Manufacturing revenue shares remained stable at 27% and 6% respectively. Revenue from Services and other sources saw a minor dip from 8% to 7%.

For the fiscal year 2007, Digital IC Design revenue share increased from the previous year’s 24% to 27%, while both Functional Verification and Custom IC Design revenues continued to contribute 24% and 27% respectively for both the years. Revenues from Design for Manufacturing, reduced from 7% to 6% while both revenue from Systems Interconnect and Services and other sources fell from 9% to 8% each.

Region wise, North America’s contribution to revenue increased sequentially from 41% to 50% and Europe’s share reduced from 25% to 17%. Japan maintained its share at 22% while the rest of Asia’s contribution reduced marginally from 12% to 11%. For the year, America’s share reduced from 54% to 49%, Europe from 19% to 18% while Japan grew from 17% to 21% and Asia from 10% to 12%. The only surprise in here is that North America is growing, and not Asia.

Back to the big picture, nothing so remarkable is happening in EDA that can unlock a large number of design starts by making “experimentation” and perhaps “protoyping” affordable, at the same time accurate. [For more color on this topic, you can read “RTL Hand-off & Predictive Prototyping”.]

Manufacturability and Yield are also huge issues for semiconductor companies today. Tools that enable Design for Manufacturability (DFM) are considered a big growth opportunity, which caused Cadence to buy Clear Shape. [Read “DFM Vision” to get more color on the opportunity.] There is a small public company called PDF Solutions (PDFS) that Cadence has looked at buying from time to time, that does great work in Yield Optimization. One of these days, these acquisition thoughts could actually materialize. Meanwhile, the actual DFM R&D needs to continue happening inside Cadence.

So, the EDA industry, overall, is not a healthy industry. [Read “Future of EDA” and “Future of EDA: Addendum” for more big picture thoughts.] However, it is a “must-have” industry, if semiconductors have to be built.

Thus, within this “must-have” industry, Cadence and Synopsys are the two best-positioned companies. In the short / medium term, the growth in Cadence’s business is likely to come from using its EDA Card strategy against Mentor and Magma to take market share away. The EDA Card strategy is a powerful one against competitors with less comprehensive portfolios for the design flow.

For the moment, if you are an investor or fund manager considering buying Cadence’s stock, your bet is “Market Share” based on “EDA Cards”. Not innovation. Not Acquisition. Straight, cold Sales.

Featured Videos

Can 1M/1M Help Me Raise Money?

How Does 1M/1M Democratize Entrepreneurship Education?

How Does 1M/1M Democratize Management Consulting?

When Is The Right Time To Join 1M/1M?

Can 1M/1M Help Me With Business Development?

Can 1M/1M Help Me With Market Sizing?

Can 1M/1M Help Me Validate My Product?

Will I Have Private 1-on-1 Sessions In 1M/1M?

How Does 1M/1M Help Entrepreneurs Connect With Silicon Valley?

Mentoring or Consulting?

Why Does 1M/1M Charge $1000 a Year?

Why Does 1M/1M Partner With Local Organizations?

Why Don\’t Mentoring Networks Work?

Why Is It Important To Study With 1M/1M Now?

Dan Stewart Story

Vikrant Mathur Story